ICICI Lombard enhances

policy advisory with VideoCX.io

ICICI Lombard adopted VideoCX.io’s video advisory solution to simplify

health insurance purchases, increase conversions, and build customer trust.

At a glance

- Industry: General Insurance

- Location: India

- Use Case: Policy Advisory over Video

- Departments Covered: Health Insurance Sales, Customer Service, Distribution

At a glance

- Industry: General Insurance

- Location: India

- Use Case: Policy Advisory over Video

- Departments Covered: Health Insurance Sales, Customer Service, Distribution

ICICI Lombard

ICICI Lombard is one of India’s leading general insurance companies, providing a wide range of health, motor, and other insurance products. Many customers required detailed guidance to understand complex health insurance terms, but traditional advisory methods such as long phone calls or in-branch visits were inconvenient and often led to drop-offs. To address this, ICICI Lombard partnered with VideoCX to deliver seamless video advisory services.

Challenges

- Need for detailed guidance → Customers struggled to understand complex policy terms before purchase.

- Low conversions → Drop-offs occurred due to confusion and lack of real-time support.

- Traditional advisory limitations → Branch visits and long calls reduced convenience.

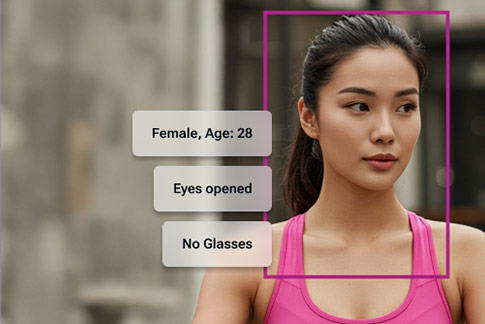

Solution by VideoCX.io

- Video advisory service → Customers connected with company advisors directly via ICICI Lombard’s website or WhatsApp chatbot.

- Policy education → Advisors explained inclusions, exclusions, and benefits in real time.

- Digital documentation support → Guidance provided for completing policy documentson a simple video call.

- Secure & compliant → All advisory sessions recorded and stored, ensuring audit readiness.

Implementation

- Customers initiated advisory sessions from the website or WhatsApp chatbot.

- A secure video session launched instantly with an ICICI Lombard advisor.

- Advisors guided customers through:

- Policy comparisons

- Package explanations

- Documentation and onboarding support

- Every interaction was recorded and stored for compliance.

Results & Impact

- Clearer understanding → Customers gained confidence through transparent, face-to-face digital interactions.

- Higher conversions → Improved decision-making reduced drop-offs and boosted policy sales.

- Enhanced trust → Recorded sessions increased transparency and accountability.

Ready to simplify insurance advisory and improve conversions at scale?

See how VideoCX.io’s secure video advisory solution helps insurers guide customers through complex health insurance decisions, reduce drop-offs, and build trust through real-time, compliant video interactions.

Explore more VideoCX.io case studies

Discover how leading banks and insurers use VideoCX.io’s video banking platform to digitize policy advisory, customer onboarding, servicing, lending, and personal discussions across regulated customer journeys.

General Insurance: Bajaj General Insurance | Porto Seguro

You can also explore case studies across Banking, Lending, and Life Insurance