AU Bank scales reach and customer service with Video Banking by VideoCX

AU Small Finance Bank adopted VideoCX’s video banking platformto expand its reach, reduce costs, and deliver seamless 24/7 banking services.

At a glance

- Industry: Banking

- Location: India

- Use Case: Video KYC, customer onboarding, 24/7 service, product cross-sell

- Spokesperson: Ahmer Hussain, National Business Head

At a glance

- Industry: Banking

- Location: India

- Use Case: Video KYC, customer onboarding, 24/7 service, product cross-sell

- Spokesperson: Ahmer Hussain, National Business Head

AU Bank

AU Small Finance Bank is one of India’s fastest-growing banks, known for innovation and customer-centricity. With limited physical presence as a relatively young institution, AU Bank turned to video banking to overcome geographic limitations, reduce operational costs, and deliver a digital-first customer experience.

Challenges

- Limited physical presence – Reaching remote customers was difficult with few branches.

- Traditional KYC processes – Time-consuming, in-person verification, restricted reach.

- High operational costs – Expanding branches to new areas was costly and slow.

Solution by VideoCX

- Seamless onboarding – Video KYC enabled remote account opening, removing the need for branch visits.

- 24/7 customer service – Always-on platform increased accessibility and convenience.

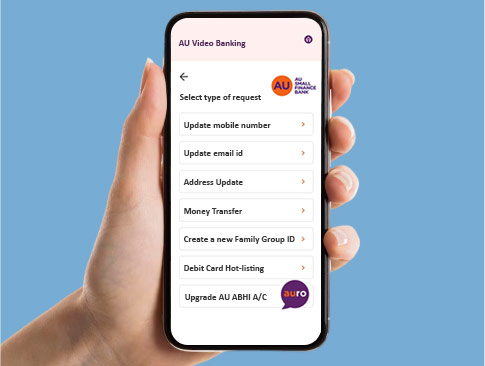

- Expanded service offering – Customers accessed account services and product cross-sell digitally.

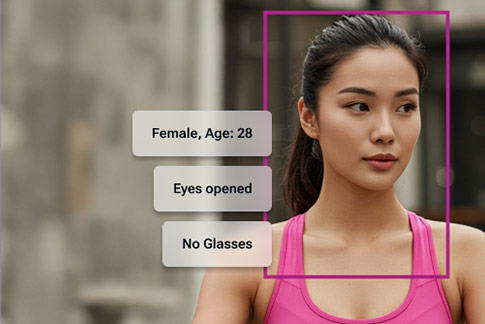

- Enhanced security – Advanced authentication and Aadhaar/PAN API integration reduced fraud risk.

Implementation

- Platform launch (2021) – Integrated into the AU 0101 mobile app after RBI approval for Video KYC.

- End-to-end integration – Unified service experience for onboarding, servicing, and cross-sell.

- Technology partnerships – Collaboration with VideoCx and Decimal ensured scalability and robustness.

Results & Impact

- Enhanced reach – Expanded banking services to geographies without branch presence.

- Higher productivity – CRMs handled more interactions per day vs. traditional branches.

- Cost reduction – Lowered costs by reducing dependence on physical branches.

- Improved customer experience – Customers enjoyed the convenience of banking from home.

- Secure transactions – Strengthened compliance and fraud prevention with advanced security.

Testimonial

“Video Banking isn’t just about convenience; it’s about revolutionizing customer serviceand expanding financial inclusion with the click of a button.”

— Ahmer Hussain, National Business Head