Digital banking has matured quickly. Most banks today can open accounts online, enable self-service transactions, and support customers through chat or call centers. Co-browsing emerged as a natural extension of this evolution. It allowed agents to “see what the customer sees” and guide them through digital forms or workflows in real time.

For low-risk, transactional interactions, co-browsing works reasonably well.

But high-value banking journeys are fundamentally different.

When the interaction involves credit decisions, wealth conversations, insurance restructuring, dispute resolution, or regulatory accountability, co-browsing alone falls short. Not because it is flawed, but because it was never designed to handle the human, regulatory, and decision complexity these moments demand.

High-Value Banking Journeys Are Decision Journeys, Not Navigation Problems

Most co-browsing use cases assume that the primary challenge is navigation.

- The customer cannot find the right option

- The form is confusing

- The workflow has too many steps

In high-value journeys, navigation is rarely the real issue.

These interactions involve:

- Ambiguity rather than clarity

- Risk rather than convenience

- Judgement rather than instruction

Examples include:

- Credit verification and personal discussion (PD) during lending decisions

- Policy servicing conversations where coverage exclusions must be explained

- Portfolio reviews where suitability and risk tolerance must be assessed

- Dispute resolution where accountability and evidence matter

In these moments, the customer is not asking “Where do I click next?”

They are asking, “Do I trust this decision and the person advising me?”

Co-browsing was not designed to answer that question.

Co-Browsing Removes Context, Which Is Critical in Banking

Co-browsing is inherently screen-centric, not context-centric.

The agent sees:

- The page

- The form

- The cursor movement

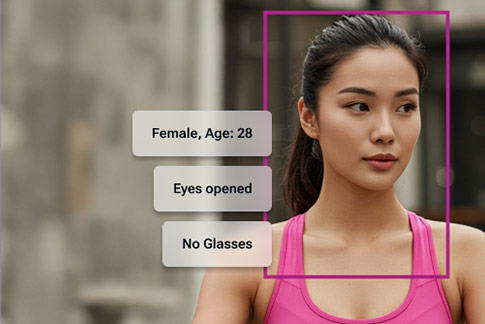

What they do not see:

- Facial hesitation

- Confusion masked by politeness

- Emotional resistance to a financial commitment

- Non-verbal cues that indicate misunderstanding or discomfort

Research from Harvard Business Review consistently highlights that trust in advisory interactions is built through social cues, tone, and perceived empathy, not just informational accuracy. Digital interfaces that remove these signals weaken trust precisely when it matters most.

This is why high-stakes advisory conversations in physical branches never relied on shared screens alone. They relied on presence.

Regulatory Accountability Cannot Be Designed Around Screens Alone

In regulated banking environments, it is not enough for an interaction to feel helpful. It must be provable, auditable, and defensible.

Co-browsing offers limited value here.

It does not reliably capture:

- Who explained what

- Whether disclosures were understood

- Whether consent was informed or merely clicked

- Whether decision checkpoints were human-verified

This becomes critical in lending, insurance, and wealth journeys.

According to Bank for International Settlements guidance on conduct and consumer protection, institutions must demonstrate not just process completion but quality of interaction, especially where customer harm is possible.

A shared screen does not establish accountability. A recorded, structured, human-led interaction does.

Complex Decisions Require Assisted Judgement, Not Passive Guidance

High-value journeys involve interpretation, not instruction.

Consider a lending PD or insurance policy restructuring conversation.

The agent must:

- Interpret customer intent

- Assess suitability

- Identify risk flags

- Escalate when thresholds are crossed

Co-browsing turns the agent into a navigator.

High-value servicing requires the agent to act as a decision facilitator.

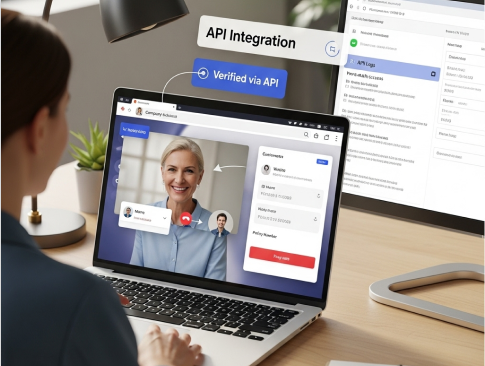

This is where assisted video workflows become essential.

Video enables:

- Human presence and authority

- Structured checkpoints

- Real-time clarification

- Decision framing, not just form completion

Platforms designed for this purpose, such as VideoCX.io’s Video Branch and Video Banking, combine interaction, workflow control, and governance into a single system rather than treating them as separate layers.

Customer Trust Is Built Through Visibility, Not Just Helpfulness

Multiple studies from McKinsey & Company show that customers are more likely to accept financial advice and complete high-value transactions when they see and hear a real advisor, especially in moments involving uncertainty or risk.

Trust is reinforced when:

- The advisor is identifiable

- The conversation feels accountable

- The interaction mirrors in-branch seriousness

Co-browsing hides the advisor behind the interface. Video brings the advisor into the experience.

This is not about replacing digital convenience. It is about elevating trust where it matters.

Operational Blind Spots Increase When Co-Browsing Is Used in Isolation

From an operations perspective, co-browsing creates data gaps.

Banks struggle to answer:

- Which journeys required human escalation

- Where customers hesitated before abandoning

- Which agents influenced outcomes positively or negatively

Without structured interaction data, continuous improvement becomes guesswork.

This is why modern servicing platforms integrate:

- Customer Journey and Routing logic

- Dashboards and Reporting tied to interaction outcomes

- Assisted decision checkpoints rather than open-ended sessions

Why Co-Browsing Works Best as a Supporting Layer, Not the Core Experience

Co-browsing is not obsolete. It is incomplete.

It works well when:

- Used alongside video conversations

- Embedded within assisted workflows

- Activated contextually rather than universally

In advanced servicing models, co-browsing becomes a supporting tool, not the experience itself.

This is why institutions are moving toward AI-enabled video banking, where co-browsing, video, workflow orchestration, and compliance controls coexist within a single interaction layer.

Designing High-Value Banking Journeys Requires a Shift in Thinking

The real question is not whether co-browsing is useful.

The question is whether your most important customer moments are being treated as:

- UI problems

- Or trust-critical decisions

High-value banking journeys demand:

- Human presence

- Structured accountability

- Assisted judgement

- Regulatory defensibility

These cannot be delivered through shared screens alone.

They require platforms designed specifically for human-led digital banking, not retrofitted tools from the self-service era.

Co-browsing helped banks scale digital assistance.

Video-led, assisted workflows help banks protect trust, reduce risk, and close high-value outcomes.

As financial products become more complex and regulators more demanding, the cost of getting these moments wrong increases.

The institutions that win will be the ones that design their most critical journeys around people, presence, and proof, not just pixels.