The Digital Branch of the Future: Why Secure Video Will Replace Physical Walk-ins

Banks are not “closing branches” so much as unbundling what the branch used to do.

For decades, a walk-in branch tried to be everything at once: identity checks, document collection, cash and service requests, relationship management, advisory, complaints, exceptions, and the human reassurance that “someone is accountable.” But customer behavior has shifted to apps for routine actions, while complex, high-trust moments still require a human. That split is why the branch of the future is increasingly a digital branch: a secure, assisted, face-to-face experience delivered through video, when and where the customer needs it.

At the same time, fraud has evolved. Deepfakes, injection attacks, and social engineering are turning “basic video calls” into risk. That is why the winner is not a generic video. It is a secure video built for regulated banking workflows.

This article explains what is changing, why secure video is becoming the new walk-in, and how banks can design a digital branch that improves service, reduces cost-to-serve, and stays compliant.

What is a “digital branch” in 2026?

A digital branch is not a chat widget and not a generic video call.

A real digital branch is a branch level interaction layer that can:

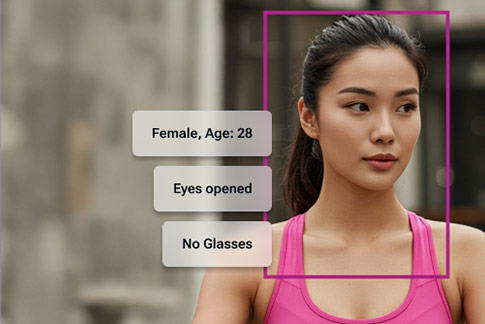

- Authenticate customers and agents via AI assisted verification technologies

- Route to the right specialist

- Support assisted servicing workflows (forms, documents, approvals, exceptions)

- Record audit evidence (where permitted), timestamps, metadata, and case logs

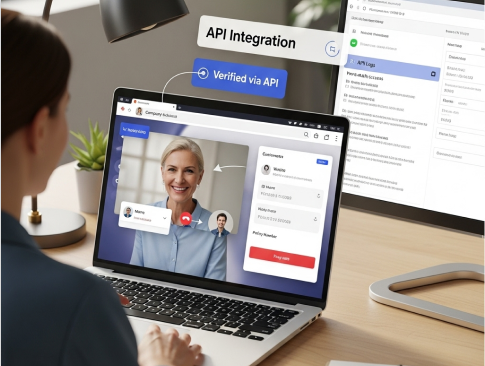

- Integrate into core systems and CRM

- Enforce policy (consent, retention, data handling, escalation paths)

- Option to upsell services

In other words, it reproduces the best parts of a branch visit, but with higher reach, better availability, low costs, improved processes and more consistent controls.

McKinsey has described how modern branches already incorporate video rooms and remote expertise to deliver sophisticated advice and service without requiring a full specialist staff in every location.

Why physical walk-ins are declining, but “human help” is not

1) Branch usage falls, but trust moments remain

Most everyday actions moved to self-serve. What’s left inside branch is disproportionately “high stakes”:

- Exceptions and disputes

- Complex servicing

- Relationship and advisory needs

- Documentation and verification steps

- High value customers and business banking

This is the crucial insight: the branch isn’t a place, it’s a capability. When you separate capability from location, video becomes the simplest way to scale that capability.

2) The economics of staffed branches are getting harder

Real estate, staffing, and limited utilization make walk-in service expensive. Meanwhile, shared service models and hub formats are expanding to compensate for closures in some regions (a clear signal that the old “one bank, one branch, one neighborhood” model is under pressure). In the UK, large-scale closures have been tracked since 2015, with thousands of sites shut and more scheduled. Refer how VideoCX.io is helping Banking & NBFC brands in UK

3) Customers now expect “face-to-face” without travel

In most industries, video has normalized for consultation, support, and high-consideration decisions. Banking is following, but with stricter requirements.

McKinsey explicitly frames remote advisory via voice or video as a capability customers appreciate and as a productivity lever for banks when scaled correctly.

Why “generic video” fails as a digital branch

A common failure pattern looks like this:

- Bank launches video support using a generic meeting tool

- Adoption grows for simple queries

- Risk and compliance teams block expansion to core journeys

- It’s very difficult and at times impossible to allow custom integration

- Teams end up with a limited pilot that never becomes “the branch”

Why? Because a digital branch needs controls that generic video is not designed to provide: identity assurance, policy enforcement, workflow evidence, and tight integration.

And now there is a second force making this gap unavoidable: AI-enabled fraud.

- Gartner warned that by 2026, AI-generated deepfakes will push 30% of enterprises to consider identity verification and authentication solutions unreliable “in isolation.”

- FinCEN issued an alert (Nov 13, 2024) describing fraud schemes using deepfake media targeting financial institutions, explicitly urging institutions to detect and report these patterns.

When faces and voices can be faked by deepfakes, a digital branch must go beyond “camera + human” — built on secure video, layered controls, and intelligent assisted workflows.

The digital branch wins because it solves 5 banking problems at once

Problem 1: Access

A walk-in branch has limited hours and limited geography. A digital branch can extend service beyond physical footprint, including rural and semi-urban coverage, without forcing customers to travel.

Problem 2: Capacity and specialization

Branches cannot staff every specialist everywhere. Video enables “hub-and-spoke expertise”: keep specialists centralized, deliver them on-demand across the network.

Problem 3: Consistency

Branch experiences vary by staff and location. A digital branch can standardize:

- Checklists

- Disclosures and consent

- Evidence capture

- Escalations and approvals

Problem 4: Cost-to-serve

Secure video reduces repeat visits, rework, and “come back tomorrow” outcomes by enabling document completion and exception handling in the same assisted session.

Problem 5: Risk and auditability

The branch historically created “comfort” because it felt controlled. A secure digital branch can be more controlled than physical, when it generates structured evidence and enforces policy across every interaction.

What “secure video” actually means in a banking context

Secure video is not just encryption. It is a full risk model, including:

Security controls

- End-to-end encryption (where appropriate)

- Device and network risk signals

- Session integrity checks

- Role-based access for agents

- Data loss prevention patterns

Fraud and impersonation controls

- Liveness and anti-spoofing signals

- Deepfake-aware review cues and escalation

- Step-up verification flows for risky cases

Compliance workflow evidence

- Time-stamped actions

- Consent capture

- Case notes and metadata

- Controlled storage, retention, and access

Regulators increasingly acknowledge remote onboarding and servicing as legitimate, but they expect institutions to manage risks systematically. For example, the European Banking Authority’s guidelines on remote customer onboarding set expectations around safe and effective remote practices aligned with AML/CFT and data protection requirements.

Even if your digital branch use case is servicing and advisory, the compliance logic is similar: risk assessment, controls, evidence, and governance.

A practical model: branch-to-digital mapping

Here is a simple mapping that helps teams design the digital branch like a product, not a pilot.

Traditional branch capability | Digital branch equivalent (secure video) | What makes it “bank-grade” |

Reception + Prioritization | Video entry point + routing | Identity context, queue logic, priority rules |

Teller/service desk | Assisted video servicing | Workflow screens, structured case capture |

Relationship manager meeting | Remote advisory | Specialist scheduling, co-browse, approvals |

Exception handling | Escalation to expert hub | Step-up verification, audit trail |

Document completion | In-session document capture | Consent, time stamps, secure storage |

“Branch evidence” | Session evidence + logs | Policy-driven retention and access |

This is the mental shift: you are not replacing branches. You are replacing walk-ins as the default path to human help.

The operating model that actually scales

The banks that scale video-based servicing typically converge on a “hub-and-spoke” structure:

1) Central expert hubs

Specialists sit in hubs (or distributed secure centers), not across every branch.

2) Digital branch entry points

Customers initiate sessions from:

- Mobile app

- Web banking

- Assisted kiosks inside smaller branches

- Call center escalation to video

3) A single case layer

Every interaction becomes a case:

- Who interacted

- What happened

- What evidence was collected

- What decisions were made

4) Clear risk tiers

Low risk interactions flow fast. High risk interactions trigger:

- Additional checks

- Supervisor review

- Alternate channels if needed

“Video will replace walk-ins” does not mean branches disappear

A realistic future is hybrid:

- Flagship branches remain for wealth, complex business needs, community presence

- Smaller branches evolve into assisted service points or advisory lounges

- Many “walk-in” needs migrate to digital branch sessions

This is already visible in policy discussions around access to cash and shared service hubs in markets facing large-scale closures. House of Lords Library

So the real claim is narrower and stronger:

Secure video will replace physical walk-ins as the default way to reach a human.

Physical branches become one of several places that human service is delivered, not the primary one.

If you too believe in the model suggested, VideoCX.io can help transform your ‘branches’ into ‘digital branches’ and service the remotest customer. We are suggesting a very simple Implementation blueprint to adopt & implement VideoCX.io with no disruption to your existing services & offering.

Implementation blueprint: 90-day path to a digital branch MVP

Phase 1: Pick one high-friction journey

Choose a journey with:

- High drop-offs

- Frequent rework

- Compliance sensitivity

- Clear business impact

Examples:

- Account servicing exceptions

- Disputes and chargebacks triage

- SME onboarding follow-ups

- High value customer servicing

Phase 2: Define what evidence you must capture

Work backward from audit and risk:

- What decisions happen?

- What proof is required?

- What should be logged?

Phase 3: Build routing and escalation rules

- First-contact resolution targets

- Escalation tiers

- Step-up checks for risky cases

Phase 4: Integrate into case management

If the session is not a case, it will not scale.

Phase 5: Train staff with a “digital branch playbook”

- How to spot manipulation attempts

- How to escalate

- How to keep sessions short and effective

FAQs

Will video increase fraud risk?

Not if it’s designed correctly. Fraud increases when institutions use consumer-grade video without strong identity, session integrity, and escalation controls. Deepfake threats are now significant enough that regulators and industry bodies are publishing explicit guidance and warnings.

Does a digital branch replace call centers?

It complements and upgrades them. The best pattern is escalation from voice to video for high-trust, high-friction moments where seeing the customer, documents, and context improves resolution.

What is the first use case to launch?

Pick a journey with high rework and high cost-to-serve, where video can reduce repeat visits and accelerate resolution. Exceptions and complex servicing are often better starting points than broad “video support.”