Digital self-service won the last decade. For routine transactions, customers actively prefer it. Bain’s NPS Prism data shows 73% of consumers prefer digital interactions over human ones for many needs.

But “digital-first” is not the same as “digital-only.”

In high-value and high-risk moments (mortgages, wealth advice, fraud disputes, limit increases, business banking servicing, KYC remediation, complex exceptions), customers want two things at once:

- The convenience of digital

- The confidence of human help

That combination is exactly where secure video outperforms chat, messaging, and co-browsing. Video is the closest digital equivalent of a branch interaction, with better speed, better reach, and often better operational leverage when designed correctly. McKinsey has repeatedly pointed out that remote advice via voice or video is highly appreciated and can become a growth engine when integrated into channel strategy.

This article breaks down why video wins for high-value banking CX, when other channels still make sense, and how to design a human led digital experience that is measurable, compliant, and conversion-focused.

Why “high-value CX” behaves differently than routine CX

Routine banking is about speed and effort reduction: balance checks, statements, card controls, basic queries. Chat and messaging can work well here, especially with good escalation.

High-value banking is different. The user’s perceived risk rises because at least one is true:

- The money amount is meaningful (loan, investment, dispute)

- The outcome is irreversible or time-sensitive (fraud, wire, account lock)

- The process is unfamiliar (mortgage, SME facilities, KYC remediation)

- The decision requires trust and explanation (advice, product suitability)

In these moments, customer behavior shifts from “let me finish quickly” to “help me get this right.”

That is why banks that remove friction at critical points see disproportionate gains in loyalty. Bain highlights a 103-point Net Promoter Score gap between customers who successfully open an account digitally and those who fail and switch. Net Promoter Score runs from –100 to +100. A gap of 103 points means the outcome of the same journey moves customers from strong recommendation to strong dissatisfaction depending entirely on whether it works the first time. Customers who succeed become advocates for the bank, while those who fail leave with negative sentiment that directly drives abandonment and switching. This is not a small difference in experience. It is a complete reversal in trust.

High-value CX is not just about support. It is about preventing failure states that permanently change how customers perceive the institution.

Video’s core advantage: it carries trust, clarity, and accountability

Chat, messaging, and co-browsing are helpful tools. But they compress the human experience. Video restores key elements that matter disproportionately in high-value banking:

1) Trust transfer: face-to-face signals reduce perceived risk

Humans calibrate trust through visual cues: attention, confidence, empathy, and credibility. Video carries those signals. Text does not.

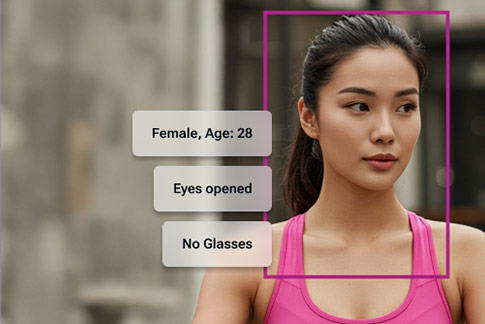

This is one reason virtual advisory models can outperform expectations when done well. McKinsey’s research on virtual financial advice notes that customers often still prefer human contact for important sales, and that a strong virtual model can achieve cost-to-serve reductions (up to 40–50%) while improving satisfaction versus some in-person models. Not to mention the fact that AI technologies help authenticate and validate customers.

2) Clarity: complex issues resolve faster when you can show and explain

High-value banking interactions often involve nuance: eligibility, documents, exceptions, timelines, policy, risk checks.

Video lets an agent:

- explain with tone and pacing

- confirm understanding in real time

- catch confusion early (before it becomes a complaint)

- reduce repeated contacts

This matters because high-value users punish friction more than they punish wait time. They want confidence, not just speed.

3) Accountability: stronger auditability and process control in assisted flows

A well-designed secure video workflow can improve documentation and control compared to informal channels, especially when paired with:

- consent capture

- event logs

- session metadata

- structured dispositioning

- optional recording where permitted

This is also why many banks push toward integrated, governed remote advisory rather than ad hoc consumer video tools.

The channel comparison that matters: what breaks under high-value pressure

Here is a practical comparison across CX and risk dimensions.

Dimension | Secure Video (Human-led) | Live Chat | Messaging (WhatsApp, in-app) | Co-browsing / Screen-share |

Best for | High-stakes servicing, advice, exceptions, complex remediation | Simple to medium queries, triage, guided flows | Updates, reminders, low-complexity support, async follow-ups | Form filling help, navigation support (when tightly controlled) |

Trust building | Strong (face-to-face) | Low to medium | Low to medium | Medium (but trust can drop if privacy concerns appear) |

Complexity handling | Strong (explain + confirm + adapt) | Medium (threading limits) | Medium (async delays) | Medium to strong (if safe and narrow scope) |

Drop-off risk | Lower once connected | Higher when threads get long | Higher if replies are delayed | Can spike if users fear “being watched” |

Fraud and social engineering resistance | Stronger when combined with identity checks and human judgment | Weaker (text-only manipulation easier) | Weaker | Mixed (can help, but privacy risk must be controlled) |

Compliance posture | Strong when purpose-built for BFSI | Mixed | Mixed | Mixed to high risk if not field-masked and tightly scoped |

Mobile experience | Good (if optimized) | Good | Excellent | Often inconsistent on mobile |

Operational leverage | High with right routing and skills | High for volume | High for follow-ups | Medium (special handling, higher risk controls) |

Key point: video is not trying to replace chat. It is the escalation destination for moments that need trust, speed-to-resolution, and human reassurance.

Why chat and messaging struggle in high-value banking

Chat issue 1: conversations get long, then expensive

Chat is great until the customer’s situation requires context, documents, and multi-step decisions. Threads grow. Repetition grows. Transfers grow.

Also, customers increasingly suspect they are talking to automation even when they are not, which changes how candid they are about sensitive issues.

Chat issue 2: AI helps, but it does not remove the need for humans

GenAI will keep improving. Gartner predicts that by 2029, agentic AI could autonomously resolve 80% of common customer service issues, reducing costs.

But “common issues” are exactly the opposite of high-value edge cases.

Even outside banking, the market is relearning that fully automated service has limits. Reuters reported how companies like Klarna had to dial back automation and re-emphasize human support because many customers still prefer people for complex scenarios.

In banking, the tolerance for wrong answers is far lower because errors can become regulatory issues, fraud loss, or reputational damage.

Messaging issue: async is great for convenience, but weak for resolution speed

Messaging shines for:

- appointment scheduling

- document reminders

- status updates

- follow-up after a call

It is weaker when:

- the user is anxious

- the issue is urgent

- the decision is complex

- identity must be verified strongly

High-value CX needs compression of time-to-clarity. Video does that.

The truth about co-browsing: powerful, but often misunderstood

Co-browsing can be excellent when it is:

- restricted to the web app context

- field-masked for sensitive inputs

- clearly consent-driven

- logged and governed

If it is treated like generic screen-sharing, it creates risk because sensitive data exposure becomes easier, and user comfort drops. PCI DSS exists because payment and authentication data exposure is a serious risk category.

Some co-browsing vendors explicitly position “field masking” and controlled access as the difference between safe co-browsing and risky screen-sharing.

Best practice in banking CX: use co-browsing as a supporting tool, but anchor high-value interactions in a human-led video workflow where trust and accountability are stronger.

A practical operating model: Human-led digital CX in 4 layers

This is the architecture that consistently works for banks.

Layer 1: Digital self-service (fast path)

- FAQ, in-app help, contextual tips

- forms with smart validation

- status tracking

Goal: deflect true routine work.

Layer 2: Chat for triage and intent capture

Chat should do three things well:

- identify the customer’s intent

- collect minimum required context

- route to the right outcome fast

If the journey smells like “high-value,” chat should not prolong it.

Layer 3: Secure video for resolution and conversion

Video should be the default for:

- high-value product conversations (mortgages, wealth, SME)

- sensitive servicing (fraud, disputes, account blocks)

- exception handling (docs mismatch, address mismatch, remediation)

- relationship deepening (retention, cross-sell with suitability)

Layer 4: Messaging for follow-ups and continuity

Use messaging to:

- confirm next steps

- send secure links

- remind customers of documents

- share appointment and callback windows

This turns one-time resolutions into ongoing relationships.

What high-performing video banking journeys look like

1) “Video-first escalation” triggers

Define rules that automatically recommend video when:

- transaction value crosses a threshold

- the customer repeats the same intent twice

- the journey fails once (form drop-off, KYC remediation)

- fraud keywords or dispute signals appear

- the customer is in a high-value segment

2) Skill-based routing, not just queue-based routing

High-value CX breaks when any agent handles any problem.

Route by:

- product expertise (mortgage, wealth, SME)

- risk handling (fraud, disputes)

- language and accessibility needs

- customer tier

3) Structured session outcomes

Every video session should end with:

- disposition codes

- next step owner

- document checklist

- timestamps and audit log

- customer confirmation of what happens next

This is how you turn “a call” into a governed workflow.

4) Measurement that ties CX to business outcomes

Measure:

- First contact resolution

- Time to resolution

- Drop-off rate pre-connection

- Repeat contact within 7 days

- Conversion rate on assisted sales journeys

- Complaint rate and escalations

If you are evaluating a secure video layer, the selection criteria should map to the model above:

- Security and governance: consent, audit trails, controls

- Journey design: ability to embed video into onboarding and servicing flows

- Routing and productivity: queues, skill routing, analytics

- Compliance readiness: controls aligned with risk management expectations for authentication and access

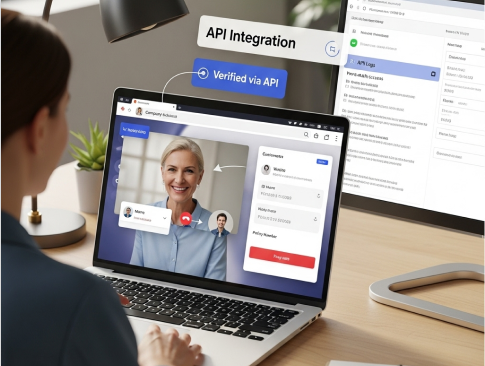

You can also have a quick glimpse at how brands in Banking, Lending, Life Insurance & General Insurance are using VideoCX.io’s video banking platform

FAQ

Is video banking better than chat for customer support?

For routine questions, chat can be cheaper and fast. For complex, high-stakes issues and high-value customers, video typically resolves faster, builds trust better, and reduces multi-contact loops.

Does video increase conversion in banking sales journeys?

It often does when the journey requires explanation, reassurance, or exception handling. Research on virtual advisory and integrated remote advice positions video as a growth lever when scaled and integrated into channel strategy.

Is co-browsing safe for banking?

It can be, if restricted to the banking web app, field-masked, consent-driven, and logged. Generic screen-sharing patterns increase privacy and compliance risk, especially around sensitive or payment-related fields.

Will AI replace human agents in banking CX?

AI will automate many common issues. Gartner expects significant automation for common service cases over time. But high-value edge cases still require human judgment, reassurance, and accountability.