How RMs and Wealth Advisors Can Use Secure Video for High-Trust Client Engagement

Wealth management requires clarity in advice, depth in interaction, and confidence in governance.Secure video strengthens all three because it preserves conversational nuance while anchoring interactions in guided, auditable workflows built for regulated financial services. This article explains how relationship managers and wealth advisors should use secure video in real operational contexts, supported by credible third-party research and regulatory insight.

The strategic case for secure video in wealth management

Clients increasingly expect seamless digital access to their advisors, especially in affluent and high-net-worth segments. Research shows that remote advisory channels such as video have moved from convenience tools to strategic engagement assets.

McKinsey’s research on virtual financial advisors highlights that digital advisory models incorporating structured remote engagement retain personalized service while reducing cost-to-serve and supporting governance requirements.

Trust in wealth advisory is built through interaction quality

Clients evaluate trust through consistency of advice, clarity during uncertainty, and confidence that their interests are protected during high-impact decisions.

BlackRock’s guidance on virtual engagement identifies credibility, reliability, and intimacy as the foundations of trust in digital advisory relationships. Trust improves when advisors communicate with structure, demonstrate understanding of client objectives, and use channels that preserve professionalism and privacy.

Secure video supports trust by enabling face-to-face interaction, shared visual context, and structured decision flow. These factors materially influence how clients interpret advice and risk explanations.

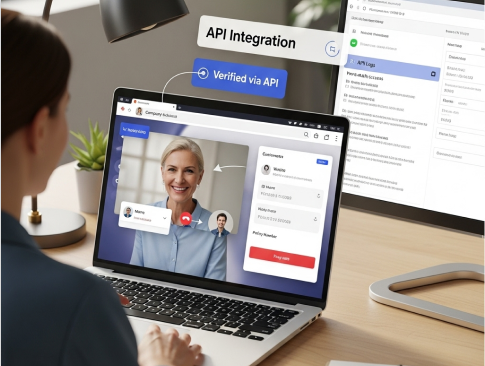

What secure video means in a wealth advisory context

Secure video in wealth management functions as a policy-controlled advisory environment rather than a generic video call. It supports identity confidence, structured conversations, documented outcomes, and alignment with internal governance rules.

In practice, secure video enables controlled session initiation, advisor routing based on intent, embedded disclosures, and outcome documentation linked to compliance systems. Firms that design video around advisory workflows achieve stronger trust outcomes than those that treat it as a standalone communication layer.

For a deeper understanding of how advisory on video environments are structured, see secure video banking platform

Where secure video strengthens trust across the wealth lifecycle

Discovery and first advisory conversations

Early conversations define long-term client perception. Secure video allows RMs to conduct discovery with presence while maintaining discipline.

High-performing teams standardize agenda setting, risk appetite confirmation, goal articulation, and next-step documentation. When discovery identifies adjacent needs such as lending or insurance, sessions are routed to the appropriate specialist without context loss.

This approach aligns with structured journey design in regulated environments. Learn more about customer journey routing for advisory teams

Portfolio reviews during volatile markets

Portfolio discussions require narrative clarity, not just performance reporting. Secure video allows advisors to guide clients through objectives, allocation logic, risk exposure, and performance drivers in a single structured flow.

McKinsey research shows that analytics-driven and digitally enabled advisory models improve personalization and client confidence when visual engagement tools are embedded in the advisory process.

See how Videocx.io’s dashboards and reporting within video sessions support these conversations

High-risk approvals and sensitive changes

Certain actions such as beneficiary changes, high-value redemptions, and mandate modifications require heightened scrutiny. Secure video supports these moments by combining human confirmation with structured verification and documented consent.

Video-based verification and assisted confirmation workflows are widely used across financial services to reduce fraud and operational risk, particularly in lending and insurance servicing contexts.

Explore video-based credit and verification workflows

Multi-party family and succession discussions

Wealth decisions often involve families and multiple stakeholders. Secure video enables inclusive conversations without compromising privacy or governance standards.

Explore VideoCX.io’s video conferencing Demo

Compliance, supervision, and recordkeeping considerations

Wealth advisory communications are subject to supervision and retention obligations depending on jurisdiction and business model. In broker-dealer contexts,

Secure video platforms help firms define permitted session types, capture structured outcomes, and integrate advisory interactions with compliance systems.

For institutions that require system-level integration, review VideoCx.io’s enterprise APIs for compliance and audit workflows

Advisor productivity and operating leverage

Wealth firms face rising client expectations alongside advisor capacity constraints. McKinsey research highlights a looming advisor shortage that makes productivity improvements essential.

Secure video improves operating leverage by reducing repetitive explanations, minimizing scheduling friction, and standardizing documentation.

See how custom video workflows reduce administrative load

Technology architecture wealth IT teams accept

Embedded access within digital client environments

Clients prefer advisory access within familiar digital channels. SDK-based video integration supports this by embedding secure video directly inside mobile apps and portals.

Learn about WebView SDK integration for client apps

Best practices RMs should adopt on secure video

BlackRock’s guidance on building virtual trust highlights actions that map directly to secure video use:

- Prepare clients with clear connection instructions and context ahead of time

- Reinforce credibility through consistent communication style

- Foster intimacy by acknowledging client priorities explicitly

When these practices are blended with structured workflows, they become part of the firm’s engagement fabric rather than ad hoc tasks.

Key takeaways for wealth advisors

Secure video does more than enable remote contact; it formalizes advisory interactions in ways that reflect both client expectations and enterprise governance requirements. As wealth clients adopt digital comfort at scale, advisors who combine presence, structure, and compliance in their engagements will sustain deeper trust and stronger business outcomes.

How VideoCX.io supports high-trust wealth advisory

VideoCX.io is designed for regulated financial institutions that require more than generic video interactions. The platform enables relationship managers and wealth advisors to conduct secure, structured video engagements that align with compliance requirements, internal workflows, and enterprise security standards. From discovery and portfolio reviews to sensitive approvals and family discussions, VideoCX.io helps advisory teams maintain control, documentation, and continuity across the entire client lifecycle.

If you are a relationship manager or wealth advisory leader looking to strengthen client trust while scaling digital engagement responsibly, connect with the VideoCX.io team to explore how secure video can be embedded into your advisory workflows.