Video Banking vs Video KYC: What’s the Difference and Why It Matters for Banks

The global banking industry is undergoing one of the fastest channel shifts in modern history. Customer expectations have moved decisively toward digital-first engagement, yet the demand for human assistance remains strong. This has led to rapid growth in two distinct categories of video-led customer interaction. These are video banking and video KYC.

While the terms sound similar, they serve very different purposes. Video banking enables remote branch experiences, real time servicing, lending, advisory, and digital support. Video KYC enables secure, regulator-approved identity verification during onboarding.

This article brings together global research, consulting insights, and market data to explain how video banking is evolving, when video KYC is needed, and why banks should treat them as complementary but independent capabilities.

Why Banks Are Moving to Video Led Customer Journeys

The shift toward video is driven by three global trends.

1. Branch usage has declined sharply

While transactions have moved to digital channels, with 72% of customers using mobile apps for transactional services (Deloitte: Accelerating digital transformation in banking), the decline in physical traffic is now primarily a generational issue. McKinsey’s 2025 analysis highlights the danger of relying on outdated channels, noting that a heavy reliance on physical channels is a primary weakness for midcap banks, as digital-native Millennials and Gen Z now account for the largest growth segment (McKinsey: Banking on the next generation).

2. Customers still want human guidance for complex journeys

Digital apps are “functionally correct, but emotionally devoid.” The need for human assurance on high-stakes decisions remains critical, as 67% of customers still desire a local branch presence according to the Accenture: Global Banking Consumer Study 2025. This gap leads to high churn, with 58% of customers acquiring a new product from a different provider in the last year. Video banking directly bridges this gap, delivering the reassurance required for lending and advisory services, in line with the BCG principle that successful technology must complement and improve the work of humans (BCG: Closing the AI Impact Gap).

3. Fraud during digital onboarding is rising

Digital friction is a conversion killer: 68% of consumers abandon financial applications when the process becomes cumbersome, according to a report. Simultaneously, fraud risk is spiking. Javelin Strategy & Research 2025 Identity Fraud Study reported that New Account Fraud losses reached $6.2 billion in 2024. This dual challenge makes Video KYC, which combines high security with streamlined, guided verification, an essential layer for both conversion and compliance.

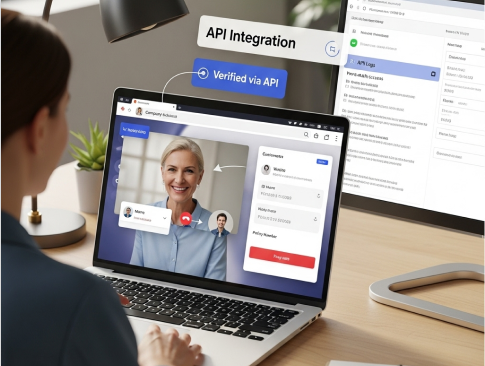

What Is Video Banking

Video banking is a secure, real time digital channel that allows customers to speak with bank representatives from anywhere. It mirrors the branch experience by enabling servicing, advisory, lending journeys, product assistance, digital walkthroughs, and issue resolution.

A complete video banking environment includes:

- Customer journey and routing

- Two-way video sessions

- Screen sharing and document sharing

- Co browsing

- Agent controls, queues, and escalation flows

- Role based routing and skill based assignment

- Dashboards and reporting for service analytics

- Integration with the bank’s systems

- Secure recording and audit trails

Platforms like VideoCX.io are built as video first products. Every part of the platform, from the hosting environment to the workflow engine, is engineered for video led financial journeys. This is different from generic CX suites that add video as a small feature.

What customers use video banking for

- Loan servicing and clarifications

- Credit verification discussions

- Insurance servicing (anchor: insurance policy servicing)

- Wealth advisory

- Remote relationship management

- Query resolution

- Guided digital journeys

- High value product discussions

Forrester research shows that customers rate video assisted digital journeys at nearly double the satisfaction level of chatbot or voice assisted journeys. This is because video provides clarity, trust, and speed without losing the personal connection, aligning with the core principle that firms must prioritize a seamless engagement experience across all touchpoints to prevent customers from feeling frustrated by disconnected service

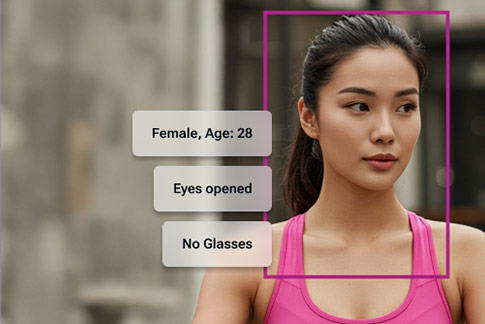

What Is Video KYC

Video KYC is a regulated process that verifies a customer’s identity over live video. It replaces in person KYC by allowing banks to complete verification remotely while meeting strict compliance standards.

A typical compliant video KYC workflow includes:

- Live video interaction with an agent

- Capture of ID documents

- Liveness checks and facial match

- Geo tagged verification (where applicable)

- Randomized questioning

- Secure recording and storage

- Maker checker and QC layers

- Audit trails and verifiable logs

Since identity verification is highly sensitive, video KYC requires tamper resistant systems, secure hosting, encryption, and compliance readiness. Fraud attempts during onboarding continue to rise globally, so regulators and banks are increasingly prioritizing video based verification.

Video Banking vs Video KYC: The Core Differences

To simplify the differences, here is a unified comparison table that captures the functional, compliance, technical, and business distinctions between video banking and video KYC.

Dimension | Video Banking | Video KYC |

Primary Purpose | Remote branch experience, servicing, advisory, lending assistance | Regulated identity verification during onboarding |

Customer Lifecycle Stage | Entire lifecycle from onboarding to servicing and retention | Only the verification step of onboarding |

Interaction Style | Conversational, flexible, customer driven | Structured, compliance driven, scripted |

Workflow Type | Dynamic workflows with routing, co browsing, guidance, escalations | Rigid workflows with liveness checks, facial match, document capture |

Regulatory Sensitivity | Moderate, focused on data protection | Very high due to identity verification requirements |

Audit Requirements | Basic session logs and recordings | Detailed audit trails, QC layers, risk checks, geo tagging (if required) |

Fraud Sensitivity | Medium | Very high, part of fraud prevention |

Technology Requirements | Routing engine, dashboards, reporting, journey orchestration | Secure capture, anti spoofing, encrypted recording, compliance workflows |

Use Case Volume | Many across lending, insurance, wealth, servicing | Single onboarding verification journey |

Business Outcomes | Higher customer satisfaction, reduced branch load, better cross sell | Faster onboarding, lower drop offs, reduced fraud attempts |

Frequency of Use | Repeated throughout the customer lifecycle | Once during onboarding |

Customer Expectation | Clarity, guidance, problem solving | Accuracy, speed, security |

This table provides a clear snapshot of how both capabilities differ and why banks must treat them separately when designing digital journeys.

Why Video Banking Is Becoming a Strategic Channel for Banks

1. Lack of clarity in self service journeys

Customers frequently abandon digital flows because they do not understand terms, steps, or document requirements. Video banking provides instant guidance.

2. Human trust is essential for complex products

Accenture reports that remote human engagement in lending and wealth products increases cross sell success by 20 to 25 percent. High value decisions require reassurance, and video banking offers that without requiring a branch visit.

3. Operational cost efficiency

Remote servicing can reduce operational costs by 15 to 40 percent depending on the journey mix. Banks can shift a portion of service traffic out of branches into digital channels without losing personalisation.

4. Lower drop offs in digital journeys

Digital journeys with video support have 15 to 18 percent lower abandonment rates. When customers are stuck, a live expert is a click away. This keeps journeys moving and prevents revenue leakage.

Why Video KYC Remains Critical in Digital Transformation

Even though onboarding is only one part of the customer relationship, it is the most important part. If verification fails, everything else stops. Video KYC provides:

1. Strong identity assurance

Video KYC combines human checks with technology such as facial matching and liveness detection. This makes it harder for fraudsters to bypass systems.

2. Compliance readiness across markets

Although regulations differ by region, most global frameworks emphasise:

- Real time presence

- Liveness verification

- Detailed audit logs

- Secure recording

- Strong identity validation

This aligns with recommendations from FATF, AMLD6, and region-specific digital KYC frameworks.

3. Faster digital onboarding

Banks using video KYC have reported up to an 80 percent reduction in onboarding time compared to in-person processes. Faster onboarding improves conversion and reduces customer effort.

4. Fraud reduction

Since one in three digital fraud attempts occurs during onboarding, video KYC offers an essential layer of protection. Human-in-the-loop verification reduces the chances of impersonation and document fraud.

Where Video Banking and Video KYC Complement Each Other

Banks should not treat these as isolated capabilities. They work best when unified.

Video KYC initiates the relationship

It verifies identity, satisfies regulatory requirements, and activates the account.

Video Banking grows and sustains the relationship

It enables servicing, lending, advisory, and long-term engagement.

A unified platform provides shared benefits:

- Consistent customer experience

- Shared audit and compliance infrastructure

- One environment for routing, analytics, and reporting

- Lower technology overhead

- Higher customer retention

Platforms like VideoCX.io achieve this through video calling and custom workflows, AI based video analysis, a wide list of use cases, and on-prem or cloud based hosting environments

Why Banks Need a Video First Platform Instead of Add On Features

Many verification vendors and CX tools offer video as a minor module. This creates limitations in performance, security, workflow flexibility, and scale. A video first platform like VideoCX.io avoids these issues by delivering:

- Purpose built video infrastructure

- Dedicated product teams focused only on video banking

- New upgrades every 45 days

- Proven workflows across 44 plus financial journeys

- Over 100 million video calls processed

- Trusted relationships with more than 75 financial institutions

This level of depth cannot be replicated by general purpose tools.

How Banks Should Evaluate Video Banking and Video KYC Providers

When choosing a technology partner, banks should ask the following questions.

- Does the platform support both verification and servicing with equal depth

- Are workflows configurable for multiple banking journeys

- Is there a secure audit layer for compliance teams

- Does the platform offer skill based routing, queues, and escalations

- Are there role based dashboards for quality and operations

- Is liveness detection and anti spoofing built into verification

- Can the system scale for high volume interactions

- Is the product video first rather than a secondary feature in a larger suite

Banks that evaluate providers through this lens can avoid poor implementations and ensure reliable digital operations.

Video banking and video KYC are foundational to the future of financial services. They serve different purposes but work best when deployed together on a unified video first platform. Video KYC handles secure identity verification during onboarding. Video banking delivers remote servicing, advisory, and customer support throughout the relationship.

As branch traffic declines and customers demand human assistance in digital channels, banks that invest in robust video infrastructure will deliver better customer experiences and stronger operational performance.