The State of Banking in India

India’s banking journey over the past ten years serves as an example of how scale, design, and policy synergy can result in revolutionary change. One of the most dynamic digital banking ecosystems in the world is emerging from a system that was previously limited by infrastructure and geography. India’s architecture, including its institutional design, public infrastructure, regulatory enablers, and experimental culture, is what sets it apart from other countries.

We delve deeper in this piece by including case studies, risk governance, technology stack evolution, customer behavior, macro context, and forward vision. The objective is to create a story that can serve as a guide, a thought-leadership piece, and a model for comparative global work.

1. Macro Backdrop: Banking’s Role in India’s Growth

In India, banks serve as more than just financial intermediaries; they are levers of national strategy.

- India’s credit-to-GDP ratio remains lower than many mature economies, pointing to growth potential.

- Banking supports infrastructure financing, MSME credit, agricultural lending, subsidy flows, and social welfare.

- The JAM trinity (Jan Dhan + Aadhaar + Mobile) links citizens, identity, and devices to financial products, making scale possible.

Therefore, every advancement in digital banking supports India’s goals of formalization, economic inclusion, and fiscal efficiency in addition to increasing profits.

2. India’s Banking Structure & Reach

A. Banking Landscape

As of mid-2025, India’s banking system is comprised of:

- 12 Public Sector Banks (PSBs)

- 21 Private Sector Banks (PVBs)

- 28 Regional Rural Banks (RRBs)

- 44 Foreign Banks (FBs)

- 11 Small Finance Banks (SFBs)

- 5 Payments Banks (PBs)

- 2 Local Area Banks (LABs)

(Plus cooperative & non-scheduled banks) [Wikipedia; Ministry of Finance Banking Overview]

135 of these are scheduled commercial banks that provide a wide range of services. Specialization (such as payments banks and rural finance) is made possible by this diversity, but it also adds complexity to monitoring, connectivity, and regulations.

B. Branch & ATM Penetration

Bricks are important despite the digital advancement..

- In 2022, scheduled commercial banks had 84,256 branches across rural, semi-urban, urban, and metro zones [RBI Publication].

- Among these, PSBs maintained 28,762 rural branches, whereas private banks had 11,971 semi-urban and 10,069 metro branches [RBI].

- Simultaneously, the number of branches increased from approximately 117,990 to 160,501 between March 2014 and September 2024, with approximately 100,686 of those located in rural and semi-urban areas [Press Information Bureau].

Interpretation:

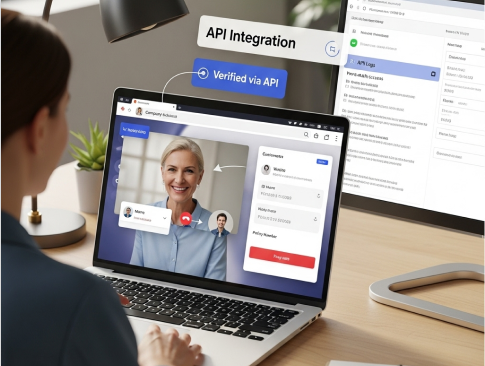

Branches are now anchors of fulfillment and trust rather than growth levers. Their utility depends on whether they can integrate with digital channels rather than operate in silos.[We at VideoCX.io are of the opinion that branches are important from access, trust & brand factor. However to bring in real scale, there’s a lot that can be achieved these days remotely with our Video Branch solution. ]

C. Who’s Driving Digital Growth

- The new growth engines are Tier-2 and Tier-3 cities. The Economic Times reports that more than 40% of consumers in Tier 3–6 cities use digital payments on a daily basis, and reports such as ICRIER’s State of India Digital Economy 2024 note rapid adoption of digital services outside metros [ICRIER SIDE 2024; Economic Times].

- Women’s account ownership increased from approximately 43 percent in 2014 to 77.5 percent in 2021, closing the gender gap and demonstrating the surge in female financial inclusion. [World Bank Global Findex 2021 Country Brief – India; Gender Data Portal].

3. UPI and Digital Payments at Scale

A. UPI’s Milestones

The Unified Payments Interface (UPI) is the backbone of India’s digital economy.

- In August 2025, UPI surpassed 20 billion monthly transactions, totaling ₹ 24.85 lakh crore in value. This was a first for any month. [NPCI]

- 675 banks live on UPI (June 2025) up from 602 a year earlier [FXC Intelligence].

- UPI handled 669 million daily transactions in August 2025 [NPCI Monthly Metrics].

These figures highlight a highly efficient payments system that is maturing.

B. Comparing Globally: UPI & Alternatives

India is not alone in real-time payments. But UPI stands out:

- Zelle in the US, Faster Payments in the UK, and New Payments Platform (NPP) in Australia deliver real-time transfers, although frequently with restricted cost or connectivity.

- UPI is interoperable, banks and fintechs plug into a common rail, and many user transactions are free or near-zero cost. This public-good nature gives it scale and reach unmatched in many economies.

C. Towards Credit & Lending via UPI

The next frontier is embedding credit:

- Credit-line integration through UPI is being piloted by banks and fintechs, enabling consumers and small businesses to obtain credit without exiting the payment flow. [VideoCX.io’s remote credit lending solution is one such tech solution]

- Meanwhile, the digital rupee (e₹) pilot is expanding rapidly. As of mid-2025, the e-rupee in circulation stood at ₹ 1,016.5 crore, involving 17 banks and over 600,000 users, with tests underway for programmability and cross-border use (MediaNama; Cointelegraph).

In order to move closer to embedded finance, these experiments seek to reduce the friction between credit and payments.

4. Global Context: India, US, Australia Comparison

Metric | India (2025) | U.S. | Australia |

Population | 1.43 B | 333 M | 26 M |

Banked Adults (%) | 89% (2024) | 95% | 99% |

Real-Time Payments Volume (monthly) | 20B+ | 2B (Zelle scale) | 400M (NPP) |

Fintech / Digital Adoption | 87% (India’s digital payment adaptability) | 65% | 70% |

Cost per transaction | Near-zero | Variable | Moderate |

Digital Public Infrastructure | India Stack (AADHAAR, UPI, AA) | Fragmented | Mixed / Layered |

Cross-Border UPI integrations | UAE, Singapore, France, Nepal, Bhutan, Mauritius, Sri Lanka | None (interbank) | Emerging pilots |

India’s public rails plus private services model is frequently used as a model by other countries. [VideoCX.io has also launched it’s solution for AU, US & UK markets.]

5. Top Banks & Digital Strategy Deep Dive

A. Public Sector Leaders

State Bank of India (SBI)

- Among UPI top remitters: over 5,368 million volume in August 2025.

- Digital investments: YONO superapp (banking + commerce + investments), video KYC pilots, AI scoring, and deep branch modernization.

Punjab National Bank (PNB)

- Emphasis on upgrading legacy systems, creating omnichannel workflows, automating credit risk, branch digitization.

Bank of Baroda (BoB)

- Hybrid bank: retail, corporate, trade. Investing in digital loans, customer analytics, and branch modernization.

Even though PSBs deal with constraints (NPAs, scale, political mandates), their rural banking presence gives them strategic relevance.

B. Private Banks: Agility & Innovation

HDFC Bank

- Highly rated digital maturity. Strong use of data analytics, ecosystem tie-ups, and customer-centric product bundling.

ICICI Bank

- Early adopter: blockchain for trade finance, video banking, open API ecosystems. Digital lending arms (ICICI iMobile, InstaBiz) are frontrunners.

Axis Bank

- Focus on embedded finance, fintech integration, and API-first models. In August 2025, processed 902.87 million remitter UPI transactions

In general, PVBs maintain lower NPAs, more capital flexibility, and thus can invest aggressively in growth, tech, and customer acquisition.

6. Technology & Architecture Evolution

A key reason India has scaled is that its banking technology stack also modernized rapidly.

Layer | Legacy (Pre-2015) | Modern (2025) |

Core banking | Monolithic, on-premise | Cloud-based, microservices |

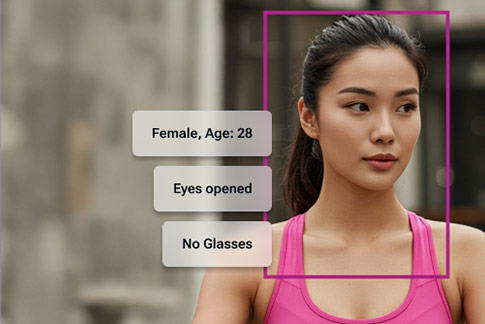

Onboarding | Physical, manual | eKYC + Video KYC |

Integration | Proprietary APIs | Open APIs, plug-and-play |

Analytics | Batch reporting | Real-time AI/ML, predictive engines |

UX | Branch-driven | Omnichannel, mobile-first |

Compliance | Manual audits | Automated rules engines, logging, observability |

These days, banks make use of AI inference engines, streaming architectures, API gateways, low-code platforms, and containerization. This speeds up experimentation, upgrades, and scaling.

These stack evolutions naturally sit on top of VideoCX.io’s video banking platform, which bridges identity, compliance, and customer experience for banks and NBFCs transitioning to secure digital-first models.

7. Enablers: DPI, Policy & Governance

Digital Public Infrastructure (DPI)

At the heart of India’s transformation is India Stack:

- Aadhaar: Biometric identity base

- eKYC / eSign: Digital verification

- UPI: Real-time payments rail

- Account Aggregator (AA): Consent-based financial data sharing (open banking)

The DPI allows banks and fintechs to build services without re-inventing identity or payments infrastructure.

Regulatory & Institutional Frameworks

- NPCI: Oversees UPI, API standards, performance SLAs, and system stability.

- RBI: Guards systemic risk, monitors cyber & fraud frameworks, enforces banking rules.

- Pradhan Mantri Jan Dhan Yojana (PMJDY): As of January 2025, more than 54.58 crore accounts had been opened under PMJDY, with aggregate deposits of about ₹ 2.46 lakh crore. Source: PIB India (official X update)

- National Strategy for Financial Inclusion : Sets long-term objectives for coverage, literacy, consumer protection, and innovation.

The governance and trust layers are essential since a large portion of the fintech stack in India uses public infrastructure..

8. Challenges, Risks & Governance

No system scales without friction. India’s banking ecosystem grapples with:

Cybersecurity & Fraud

- In FY25, reported frauds surged threefold to ₹36,014 crore from ₹12,230 crore—driven by digital and loan frauds (including reclassification of cases). [The Economic Times]

- Hundreds of branches continue to have “mule accounts,” which are used by cybergangs to launder money.

Banks must invest in real-time anomaly detection, layered monitoring, identity graphs, and zero-trust models.

Legacy Debt & NPAs

PSBs still carry large non-performing portfolios from older credit cycles, constraining capital deployment for innovation or risk-taking.

Digital Literacy, Inclusion & Usability

Many users, especially in rural areas, struggle with interfaces, app literacy, and trust.

Design must be vernacular, simplified, and forgiving.

Vendor & Operational Risk

As banks outsource components, third-party risks, API outages, compliance mismatches, SLAs and cascading failures become real threats.

Regional Disparities & Underutilization

Branches in isolated locations might not be used very often. Urbanization, migration, and population changes change demand zones, necessitating dynamic models as opposed to static branch footprints.

Regulatory Uncertainty & Data Privacy

Regulatory stress is created by emerging AI, open banking, digital credit, and CBDC use cases; banks and fintech need to remain flexible and compliant.

9. Customer Behavior & Experience Trajectory

Understanding behavior is as important as infrastructure.

- The shift from cash to digital was accelerated during COVID-19, cementing habits (e.g. weekly UPI use) even after restrictions eased. [Kotak Bank was the first bank in India which launched Vkyc with VideoCX.io]

- A recent study found ~75% of users reported increased spending due to UPI’s frictionless nature, which reduces “pain of parting” with cash. [[arXiv paper “From Cash to Digital”]]

- Many Indian users rely on device-default 2FA or simple password patterns; adoption of advanced password managers is low, indicating opportunity in trust & security UX. [[Online Authentication Habits of Indian Users study]]

- Urban versus rural, income, device quality, language support, and network connectivity remain key factors in adoption.

Banks and fintechs that understand journey friction and context will outperform.

10. What’s Next: Trends & Forward Vision (2025–2030+)

Embedded Credit & UPI Lending

Expect UPI’s transition from pure payments to credit rails. This implies that small loans will be available to consumers and businesses at the point of sale. UPI will host lending APIs, credit score modules, and more.

AI, Analytics, Personalization

Lending decisions, fraud detection, retention triggers, and product bundling will increasingly run on AI and real-time models.

Cross-Border UPI & Digital Rupee

India is transforming UPI into a global payments network by connecting it to UAE, Singapore, France, Nepal, Bhutan, Mauritius, and Sri Lanka.

With ₹1,016.5 crore in circulation in 2025, the digital rupee (e₹) is currently in pilot with bank and user participation. It also has programmable features for cross-border use, micropayments, and subsidies.

ONDC, Platform Finance & BaaS

In India, the Open Network for Digital Commerce (ONDC) is changing the retail industry by generating new prospects for embedded finance, working capital, and transaction banking.

Video & Biometric Onboarding

Biometric onboarding and video KYC will become norms rather than experiments. Banks that use video-native workflows, such as liveness checks, document scanning, and face recognition, report reduced drop-offs, increased compliance, and stronger trust. VideoCX.io enables this through its secure, RBI-compliant video verification platform used across leading financial institutions.

ESG-Linked Lending & Digital Trust Scores

When banking, fintech, and identity come together, digital footprint, sustainability metrics, and behavioral scoring may be connected to credit, pricing, and access.

11. Summary & Strategic Insights

The goal of India’s banking development is to create a robust, transparent, and inclusive financial system, not merely increase the number of users. Important lessons:

- Public Infrastructure is the Leverage Point. DPI (Aadhaar, UPI, AA) did heavy lifting so services could scale.

- Regulation & Innovation Must Coexist. UPI’s success is due not just to tech, but its governance, SLAs, and adaptability.

- Physical + Digital must work in tandem. Branches anchor trust in areas without full digital adoption.

- CX and Trust will be competitive differentiators. The next stage of customer engagement will be defined by the digital delivery of the human experience through video banking solutions that integrate security, compliance, and empathy.

- India as an exporter, not Importer. The India Stack model is being studied by peers globally.