In a time when high-end digital experiences are influencing consumer expectations, financial institutions need to improve not only what they offer but also how they deliver it.Video banking bridges that gap, combining the personalization of in-branch experiences with the efficiency of digital access. Learn more about VideoCX.io’s video banking solutions designed for high-compliance, enterprise financial institutions.

Video banking is more than just a feature for a platform like VideoCX.io, which enables high-volume, safe, and compliant video interactions for BFSI clients. It serves as the cornerstone of trust-driven, humanized digital transformation.

1. What Is Video Banking?

Fundamentally, video banking involves conducting banking transactions, advisory sessions, or customer service interactions with financial representatives via real-time video interfaces.(Wikipedia).

But for high-end customers, video banking offers more than just standard teller interactions. It needs to offer:

- Integration with private banking, wealth management, and corporate advisory services.

- The ability to handle complex transactions, such as loan approvals or investment consultations.

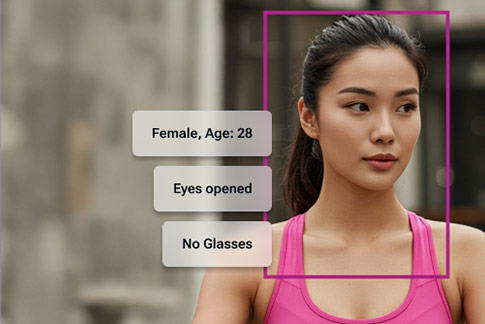

- Secure, high-quality video with features like document co-browsing, customized workflows, and secure ID verification ensures compliance and user confidence across all digital touchpoints.

- Consistency across touchpoints so that the digital experience feels as personal as in-branch service.

Video banking is already widely used by banks for account servicing and onboarding. However, it goes beyond that for VideoCX.io customers. It develops into a high-end digital relationship channel that boosts client loyalty and trust.

2. The Strategic Importance of Video Banking

2.1 Market Growth and Adoption

The global video banking service market was valued at USD 71.4 billion in 2021 and is projected to reach USD 247.9 billion by 2031, growing at a CAGR of 13.6% (Allied Market Research).

Another report estimates the market at USD 95.6 billion in 2023, expected to reach USD 273.6 billion by 2030 at a CAGR of 16.2% (Maximize Market Research).

According to Fintech Futures, 80% of global banks have plans to implement or expand video-enabled services within their digital ecosystem (Fintech Futures).

These figures show that video banking is no longer a new idea but is instead emerging as a popular way to communicate with customers and provide advice

2.2 Differentiation Through Customer Experience

Digital convenience on its own is insufficient for highly valuable customers. They anticipate experiences that blend personalization and accessibility. Video banking offers:

- Trust and rapport: Face-to-face interactions help maintain the advisory bond that clients value.

- Speed and convenience: Clients can communicate with bankers at any time and from any location.

- Continuity: Advisors can improve engagement by conducting portfolio reviews and follow-ups via video.

- Centralized expertise: Through virtual sessions, a single expert can assist clients in several different locations.

These advantages improve internal productivity as well as customer satisfaction.

2.3 Operational Efficiency and Reach

Several operational limitations associated with physical branches are removed by video banking. Expertise can be expanded by institutions without raising overhead. Additionally, it makes it possible to reach remote or international customers who might not regularly visit a branch.

Banks can provide a smooth transition from lead generation to service fulfillment by integrating with digital onboarding, CRM, and compliance systems.This is powered by customer journey and routing automation that intelligently matches clients to the right relationship managers in real time.

3. Core Architecture and Operational Pillars

Delivering a high-quality video banking experience requires both technological depth and operational discipline.

Domain | Key Considerations |

Video Infrastructure | Low-latency, HD-quality video that adapts to varying bandwidths. |

Identity Verification | Real-time document validation, liveness checks, biometric verification. |

Security and Encryption | End-to-end encryption, session-based authentication, and detailed audit trails. |

Document Handling | Co-browsing, file uploads, and integrated e-signature tools. |

Workflow Orchestration | AI-based routing, queue management, and role-based access. |

Integration Layer | Direct connection with CRM, core banking, and customer onboarding systems through APIs |

Analytics and Reporting | Quality-of-service monitoring, behavioral insights, and conversion tracking through detailed dashboards and reporting |

Compliance Controls | Data retention, consent management, and regulatory reporting. |

In contrast to generic video communication tools, VideoCX.io incorporates workflow orchestration, document collection, and secure ID verification right into the customer journey. This eliminates the complexity of third-party systems while guaranteeing compliant performance.

Industry research also shows that cloud-based deployments are expected to outpace on-premise solutions in scalability and cost-effectiveness (Maximize Market Research).

4. Risk Management and Compliance

Financial institutions have to strike a balance between innovation and regulatory obligations. The main risks and their mitigation strategies are listed below.

4.1 Identity Fraud and Deepfakes

Make use of multi-layered verification that includes anti-spoofing AI, biometric liveness detection, and document scanning. During live sessions, these precautions reduce the possibility of impersonation. These checks are often complemented by integrations with a video KYC company to strengthen identity assurance during high-risk transactions.

4.2 Data Protection

Zero-trust architecture, device-level security, and end-to-end encryption are essential. Banks ought to uphold geo-specific data storage and strictly enforce role-based access.

4.3 Compliance Alignment

Regional regulations such as GDPR (Europe), DPDP Act (India), and Federal Financial Institutions Examination Council (FFIEC) guidelines (U.S.) govern how customer data is handled and recorded.

4.4 Recording and Consent

Explicit customer consent must be captured before session recording. Each video call should have timestamped audit trails for transparency and dispute resolution.

4.5 Service Continuity

Trust can be impacted by network problems. To ensure continuity, institutions should implement redundancy, failover routing, and alternate channels such as chat or voice.

5. The Future of Video Banking

5.1 AI-Driven Interaction

AI assistants can support both bankers and customers in real time, automate document filling, and summarize discussions instantly. These capabilities are already supported through AI-based video analysis that enhances agent performance and compliance visibility.

5.2 Augmented Reality and Visualization

Banks that are prepared for the future are experimenting with augmented reality overlays, which let customers see mortgage plans or investment scenarios during live video consultations.

5.3 Unified Digital Journeys

In order to create a cohesive omnichannel experience, video banking will easily integrate with chatbots, mobile apps, and in-app notifications.

6. Why VideoCX.io Is the Right Partner for Video Banking

VideoCX.io is designed for environments that are regulated and compliance-heavy. The platform has handled more than 100 million sessions to date and currently facilitates 3 million secure video calls per month.

Key differentiators:

- Trusted by 75+ financial institutions across India and international markets, with proven results across banking, lending, and life insurance.

- Enterprise-grade encryption and security frameworks.

- Data localization and consent-based recording capabilities.

- Customizable workflows for onboarding, KYC, and support journeys.

With these capabilities, VideoCX.io helps financial institutions deploy video banking that is not only secure and compliant but also human-centered.

7. Conclusion

The term “digital-first” in financial services is being redefined by video banking. Bringing the relationship-driven aspect of banking into the digital sphere is just as important as making transactions possible online.

By using platforms like VideoCX.io, BFSI organizations can strike a balance between trust, speed, and compliance. It ensures that while processes move online, the personal touch that defines premium banking remains intact.

Those who can deliver technology with empathy, accuracy, and security will dominate the financial CX of the future, and video banking is at the forefront of this change.

To explore how VideoCX.io can power your institution’s secure, high-impact digital journeys, contact the VideoCX.io team or learn more about the platform.