The Role of Secure Video KYC in Preventing Fraud During Digital Onboarding

The Role of Secure Video KYC in Preventing Fraud During Digital Onboarding

Digital onboarding has become a core operating model for banks, NBFCs, insurers, and regulated fintechs worldwide. Customers expect instant access, regulators expect strong controls, and fraudsters actively target the gaps created by remote processes.

As Customer onboarding moves away from physical branches, identity fraud has shifted upstream. Fraudsters no longer need to compromise existing accounts. Opening an account itself has become the objective.

This is where secure video KYC plays a critical role. When implemented as a regulated, auditable workflow rather than a simple video call, video KYC adds a strong layer of fraud prevention that purely automated onboarding often cannot deliver.

This article explains why fraud concentrates during digital onboarding, the most common fraud techniques used today, and how secure video KYC helps financial institutions prevent them while remaining compliant with regulatory expectations.

Why digital onboarding attracts fraud

Onboarding is a high-leverage point for fraud because it enables everything that follows.

If a fraudster successfully completes onboarding, they can:

- Launder money through mule accounts

- Take loans using false or stolen identities

- Commit payment fraud and card misuse

- Enable account takeovers and downstream scams

Unlike transactional fraud, onboarding fraud is harder to detect retrospectively. Once an account is live, the damage compounds.

Regulators and enforcement bodies have repeatedly highlighted identity misuse and impersonation as major enablers of financial crime. Europol’s Internet Organised Crime Threat Assessment (IOCTA) consistently lists online identity fraud as a top threat vector, particularly in financial services.

At the same time, institutions face pressure to reduce onboarding friction, creating a tension between speed and assurance.

Common fraud techniques during digital onboarding

1. Impersonation using stolen identities

Fraudsters use genuine identity documents and personal data obtained from data breaches, phishing attacks, or insider leaks. Automated document checks often pass because the documents are technically valid.

The weakness is not the document. It is proving that the applicant is the rightful owner.

2. Synthetic identity fraud

Synthetic identities combine real and fabricated attributes to create a new, believable profile. These identities can pass many automated checks and may not trigger immediate red flags.

According to FATF guidance, synthetic identity fraud is particularly difficult to detect because it does not rely on a single stolen identity, but on constructed credibility over time.

3. Document manipulation and replay attacks

High-quality document forgeries, photo substitutions, and replayed videos are increasingly used to defeat static document upload flows.

In many cases, fraudsters never interact live. They submit carefully prepared inputs designed to pass once.

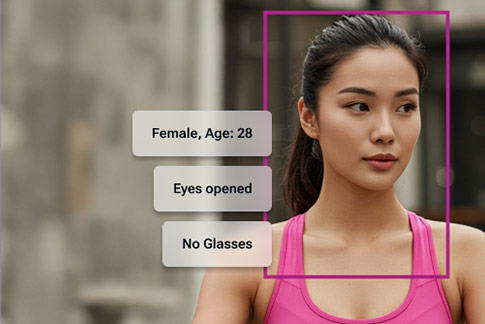

4. Deepfake and presentation attacks

AI-generated faces, screen replays, and injection attacks are becoming more accessible. Weak liveness checks are often insufficient against these techniques.

NIST’s digital identity standards explicitly warn that remote identity proofing must account for presentation attacks and spoofing risks.

5. Social engineering and mule onboarding

Some fraud cases involve real people being coached or manipulated into opening accounts they do not fully understand. This is especially common in mule networks.

Static, self-serve onboarding has limited ability to detect this behavior.

Why secure video KYC changes the fraud equation

Secure video KYC introduces live, supervised, consent-based interaction into onboarding. This fundamentally alters the fraud cost structure.

Fraud relies on automation, scale, and repeatability. Video KYC introduces unpredictability, human judgment, and evidentiary depth.

How secure video KYC prevents fraud in practice

Live presence and informed consent

Video KYC requires the customer to be present in real time, providing explicit consent to the process.

Regulators such as the RBI explicitly define video KYC as a live, informed-consent based audio-visual interaction that can be treated on par with face-to-face verification for eligible customers.

Live interaction breaks many fraud techniques that rely on pre-recorded or scripted inputs.

Stronger liveness assurance

Unlike passive selfie or upload-based flows, secure video KYC enables:

- Real-time movement and response prompts

- Observation of lighting, reflections, and depth cues

- Detection of unnatural delays or visual artifacts

These controls significantly increase resistance to replay attacks and deepfakes.

Supervised document verification

During video KYC, the verifier can dynamically request:

- Tilting or repositioning the document

- Showing both sides and edges

- Adjusting lighting to reveal security features

- Re-presenting the document if anomalies appear

This real-time supervision is difficult to defeat with static forgeries.

Human judgment and behavioral signals

Fraud often fails not because of bad data, but because of inconsistent behavior.

Trained video KYC agents can detect:

- Hesitation or coached responses

- Inability to explain personal details

- Signs of third-party prompting

- Lack of understanding of the product being opened

These signals are extremely difficult to capture through automated systems alone.

Evidence, auditability, and non-repudiation

Secure video KYC creates strong evidence artifacts:

- Time-stamped session records

- Consent capture

- Logs of checks performed

- Recorded interactions (where legally permitted)

This supports:

- Regulatory audits

- Internal investigations

- Dispute resolution

- Post-incident fraud analysis

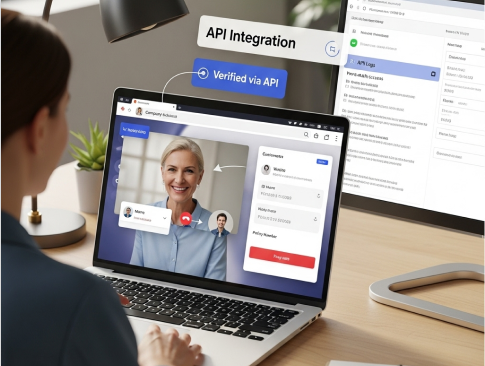

Video KYC as part of a broader digital journey

Video KYC is most effective when used as part of broader video banking journeys, rather than as a standalone verification step.

Financial institutions increasingly use secure video to support:

- Digital onboarding

- Remote servicing

- High-risk account reviews

- Assisted customer journeys

Positioning video KYC within a secure video banking layer allows institutions to maintain consistency, governance, and auditability across customer interactions.

A risk-based approach to using video KYC

Modern regulatory guidance consistently supports a risk-based approach.

Video KYC works best when used:

- For high-value or high-risk accounts

- For cross-border or non-resident customers

- As a step-up when automated checks are inconclusive

- As a remediation path for legitimate customers who fail self-serve flows

Regulatory alignment across key markets

European Union

The EBA’s Guidelines on Remote Customer Onboarding establish expectations around:

- Risk assessment

- Governance and controls

- Use of technology

- Ongoing monitoring

These guidelines have been applicable since October 2023 and apply across EU financial institutions.

Germany

BaFin’s circular on video KYC defines procedural requirements for live video verification, including consent, interaction standards, and verification steps. Germany has one of the most mature regulatory approaches to video KYC.

India

RBI’s KYC Master Directions and FAQs define Video Customer Identification Process (V-CIP) as a compliant alternative to physical verification, subject to strict procedural controls.

What makes video KYC “secure” in practice

Not all video implementations are equal.

A secure video KYC solution should include:

- Encrypted video sessions

- Role-based access controls

- Defined verification scripts and decision rules

- Agent training and quality audits

- Secure storage and controlled retention of evidence

- Integration with risk scoring and fraud monitoring systems

Using a generic video tool without these controls increases risk rather than reducing it.

Key takeaways

- Digital onboarding is a primary target for identity fraud.

- Automated checks alone are no longer sufficient for higher-risk scenarios.

- Secure video KYC adds live presence, human judgment, stronger liveness, and evidentiary strength.

- Regulators across regions explicitly recognize video KYC when implemented with proper controls.

- The most effective approach is risk-based, using video KYC where it adds the most fraud-reduction value.

For institutions evaluating their onboarding controls, the key question is simple:

Can you clearly demonstrate who was verified, how they were verified, and why the decision was made?

If not, secure video KYC deserves closer consideration.

To understand how this works in practice, you can request a demo of secure video KYC workflows designed specifically for regulated financial institutions.