Remote Banking & Servicing: How Banks Can Build Trust Without Branch Visits

Digital-first banking is no longer a competitive advantage. Customers expect mobile apps, online servicing, and 24/7 access by default. What now separates strong banks from replaceable ones is whether customers still feel understood, protected, and well supported when most interactions happen remotely.

This is the real challenge of remote servicing. Trust cannot be delivered through messaging or campaigns. It has to be designed into the service journey itself, through repeatable moments where customers experience competence, clarity, and control.

McKinsey notes that the next phase of digital banking is not about adding more channels, but about integrating digital and human interactions so banks can scale remote advice, not just transactions. Customers increasingly expect complex needs to be handled remotely without losing confidence or personal connection.

What trust really means in remote banking

Trust in banking is often treated as an abstract concept. In practice, customers evaluate trust continuously through very specific signals during servicing interactions.

In remote environments, these signals must be explicit. There is no branch presence to compensate for confusion or friction.

The four signals customers rely on

Clarity

Customers need to understand what is happening, what the bank needs from them, and what will happen next. Ambiguity is one of the fastest ways to erode trust.

This is why a strong customer journey workflow matters more in remote servicing than in physical branches.

Competence

Customers judge banks by how quickly they reach the right person and how confidently issues are resolved. Long handoffs and repeated explanations signal internal fragmentation.

Banks that invest in remote customer servicing models outperform those that rely on generic contact centers.

Control

Remote customers want visibility and choice. They expect to choose channels, approve sensitive actions, and track progress.

This is where secure customer authentication and transparent confirmation steps become critical.

Care

Some moments require empathy, reassurance, and authority. Disputes, fraud concerns, large transfers, and life events cannot be reduced to chatbots.

This is the foundation of human-led video banking, where technology supports, rather than replaces, human judgment.

Why remote servicing breaks down even in mature digital banks

Many banks have excellent apps and strong self-service capabilities, yet customers still revert to branches or repeat calls. The reason is not missing features. It is poor service design at moments of uncertainty.

Bain & Company has shown that customers who fail in digital journeys and are forced to switch channels report significantly lower loyalty than those who complete journeys successfully on the first attempt. The failure itself, not the channel, causes distrust.

Remote servicing breaks when:

- Customers cannot tell whether an issue is resolved

- Sensitive actions feel risky or poorly explained

- Escalation to a human feels slow or disconnected

This is why assisted service workflows are no longer optional for high-trust banking.

The remote journeys where trust matters most

Not all journeys carry equal emotional or financial weight. Banks that prioritize the right moments build trust faster and more sustainably.

High-value advisory and relationship banking

Portfolio reviews, credit restructuring, and protection planning require dialogue, not forms.

Banks that enable video banking for Personal Discussions consistently report stronger relationship continuity.

Exceptions and issue resolution

Disputes, chargebacks, and account access problems define how customers remember the bank.

Effective priority servicing prevents frustration from escalating into attrition.

Fraud and security moments

Fraud is as much an emotional event as a financial one. Customers need reassurance, not just controls.

This is where fraud prevention combined with human confirmation makes a measurable difference.

Sensitive life-event servicing

Bereavement support, nominee changes, and documentation-heavy requests require dignity and clarity.

A well-designed remote branch experience allows banks to handle these moments without physical visits.

The Remote Trust Stack: how banks can design confidence into servicing

Banks that succeed remotely do not rely on a single channel. They design a layered trust system.

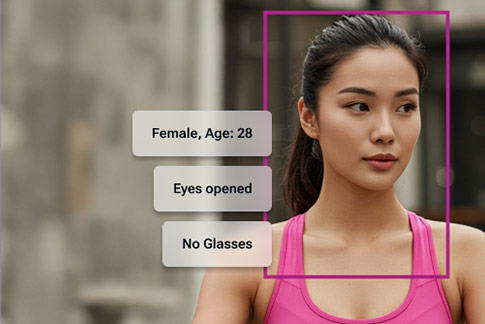

Layer 1: Identity and access customers can rely on

Remote access increases exposure. Trust starts with adaptive controls that customers understand.

Banks should embed:

- Risk-based step-up checks

- Clear explanations for why verification is required

- Strong account takeover prevention without unnecessary friction

This is the foundation of layered security.

Layer 2: Intelligent routing with full context

Customers lose confidence when they repeat themselves.

McKinsey highlights the effectiveness of universal banker and advisory hub models that allow one banker to serve customers across channels, including video.

Banks should implement:

- Skill-based and intent-based routing

- Seamless escalation to secure video banking

- Banker desktops enriched with history and context

This is where intelligent routing and the video branch hub model converge.

Layer 3: Assisted service embedded inside digital journeys

Digital journeys should never become dead ends.

Instead of forcing customers to exit the app and start again, banks should embed in-app video support and guided escalation points.

Key capabilities include:

- Immediate human assistance at high-friction steps

- Secure document sharing during live interactions

- Real-time updates and follow-ups

These assisted digital journeys preserve flow and confidence.

Layer 4: Governance, evidence, and auditability

Trust must be defensible internally and externally.

Deloitte’s digital banking research highlights that leading banks pair strong experience design with disciplined governance, especially in remote servicing.

Banks need:

- Consent capture for sensitive actions

- End-to-end audit trails

- Consistent quality monitoring across channels

This ensures remote trust is scalable, not fragile.

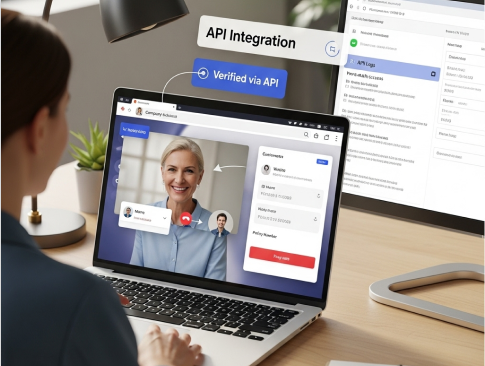

Where Videocx.io strengthens remote trust

Most banks already have digital infrastructure. What they lack is a secure, governed human layer that works at scale.

Videocx.io enables banks to deliver a true video branch experience, allowing customers to interact with verified bankers in moments that require confidence, explanation, and accountability.

Through secure video banking, banks can:

- Conduct RM-led servicing without physical visits

- Resolve disputes and high-risk requests with clarity

- Support complex servicing flows inside remote customer servicing journeys

This strengthens human-led digital CX without increasing branch dependency.

Measuring trust, not just activity

Banks often track volume. Trust requires outcome-based metrics.

Customer outcomes

- First-contact resolution for priority journeys

- Successful digital-to-human escalations

- Reduction in repeat servicing requests

Supported by dashboards and reporting.

Risk outcomes

- Fraud loss reduction

- Verification success rates

- Audit readiness

Aligned with risk controls and compliance reporting.

Operational outcomes

- Advisory capacity per banker

- Cost-to-serve reduction

- Improved advisory productivity

A practical implementation roadmap

Phase 1: Fix trust-breaking moments

Map critical journeys and introduce customer journey mapping with assisted escalation using Videocx.io.

Phase 2: Scale remote advisory

Build structured remote advisory models for high-value customers.

Phase 3: Embed governance and optimize

Formalize a governance framework that supports growth without compliance risk.

Remote banking does not win by removing branches. It wins by replacing what branches provided: confidence, accountability, and human reassurance.

Banks that combine strong digital flows with timely, secure human interaction create servicing experiences that feel both efficient and personal. With the right design and platforms like Videocx.io, trust no longer depends on physical presence.