Why Generic Video Tools Fail Compliance Requirements in BFSI

Video has become a core part of how financial institutions interact with customers. Account opening, KYC verification, loan discussions, wealth advisory sessions, fraud investigations, collections calls and dispute resolution are increasingly conducted over video channels. Regulators have acknowledged this shift. In India, the Reserve Bank of India (RBI) formally established the Video-based Customer Identification Process (V-CIP), allowing banks to perform remote onboarding under strict safeguards. Globally, supervisory bodies such as the FFIEC in the United States and regulators in the EU have tightened expectations around authentication, auditability, data governance and consumer protection.

Yet many banks and NBFCs continue to rely on general-purpose video conferencing tools like Zoom, Microsoft Teams or Google Meet for regulated customer interactions. These tools excel at collaboration but fall short when measured against regulatory expectations for identity assurance, audit trails, data protection, AML integration and conduct oversight.

This article explains why generic video tools fail compliance requirements in BFSI and outlines the capabilities required for a defensible, regulator-aligned video journey.

1. The Compliance Bar in BFSI Has Shifted Dramatically

1.1 Identity assurance is now a regulatory priority

Financial institutions worldwide are required to establish a reasonable belief that they know the true identity of each customer. This requirement underpins the global anti-money laundering (AML) framework, including FATF recommendations, US Bank Secrecy Act (BSA) rules and EU AML directives.

The FFIEC Authentication Guidance (US) stresses the need for layered authentication, identity proofing and monitoring for digital banking interactions. In practice, this means remote channels must offer the same level of confidence as in-person verification.

Meanwhile, regulators have dramatically increased enforcement intensity. In H1 2025, global regulatory penalties related to AML and KYC failures surpassed $1.23 billion, representing a 417 percent year-over-year increase (Fenergo, 2025). This surge reflects how seriously regulators now treat deficiencies in customer identification and ongoing monitoring.

1.2 India’s V-CIP Framework Raised the Global Benchmark

RBI’s definition of V-CIP explicitly positions it as an “alternate method of customer identification with facial recognition and customer due diligence” comparable to face-to-face verification (RBI, 2020). RBI’s FAQs clarify that V-CIP is treated on par with physical KYC when conducted correctly.

V-CIP mandates safeguards including:

- Live video interaction between customer and authorised bank official

- High-quality video capture of the customer and identity documents

- Liveness checks

- Geo-tagging and time-stamping

- End-to-end encrypted communication

- Secure, tamper-proof storage of evidence

- A complete audit trail of the process

These requirements are more stringent than the capabilities of general-purpose video platforms, which lack native KYC logic, liveness detection, geo-tagging and structured audit trail generation.

India’s regulatory stance is influencing other markets as well. IFSCA and GIFT City are preparing video KYC standards echoing RBI’s emphasis on encrypted communication, AI-driven verification and auditable workflows.

1.3 Global regulators expect strong authentication and accountable audit trails

Beyond India, global regulators demand robust digital identity assurance:

- GDPR mandates secure processing and regional storage of identifiable personal data, explicit consent and strict retention management.

- PSD2 requires strong customer authentication (SCA) for regulated interactions.

- MiFID II requires investment firms to record and retain client communications, including remote advisory sessions, for audit and supervision.

- FFIEC (US) requires layered security controls, customer verification and activity logging for digital banking channels.

Generic video platforms were never designed to satisfy these requirements. Their architecture prioritises convenience, not regulated evidence capture.

2. What Generic Video Tools Were Designed to Do

Platforms like Zoom, Teams and Meet were built to solve workplace collaboration challenges. Their core design principles include:

- Easy joining via links

- Guest access

- Simple screen sharing

- Flexible meeting formats

- Lightweight recordings stored in vendor-cloud environments

- User-centric controls for muting, sharing, recording

These tools are optimised for productivity, not regulation. They have:

- No concept of “regulated journeys”

- No identity verification workflows

- No liveness challenges

- No document authenticity checks

- No geo-location requirements

- No structured event logs for audit

- No built-in AML, fraud or risk signals

- No product-level disclosure enforcement for compliance

As a result, they fall short when applied to onboarding, lending, wealth advisory or other regulated interactions.

3. Where Generic Video Tools Fail Compliance Requirements

Below are the key compliance areas where generic video tools cannot meet BFSI regulatory standards.

3.1 Identity Verification and KYC / V-CIP Controls

Regulator expectations

Identity verification over video must incorporate:

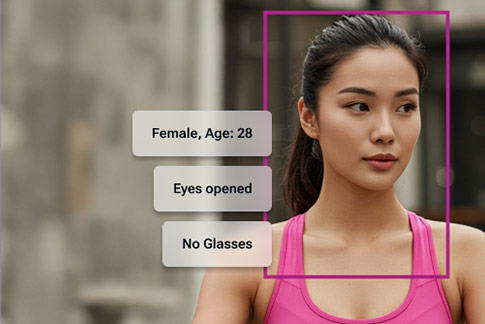

- Facial matching and liveness detection

- High-resolution capture of identity documents

- Officer-supervised interaction

- Geo-tagging

- Verification of document authenticity

- Secure audit trail

- Evidence storage compliant with local regulations

Generic video tool limitations

Generic tools:

- Cannot validate document authenticity or perform liveness checks

- Do not extract identity data from documents

- Cannot link a video session to downstream product or account creation

- Have no concept of regulated officer roles

- Cannot enforce compliance scripts for disclosures

- Provide no geo-location capture

- Offer no fraud or deepfake detection

Risk to the institution

Identity gaps weaken AML programs. As deepfakes increase, video identity spoofing is becoming a mainstream fraud vector. Without liveness and authenticity checks, institutions face heightened exposure to identity fraud and regulatory criticism.

3.2 Audit Trails and Evidentiary Requirements

Regulator expectations

Financial institutions must retain precise, retrievable evidence of regulated interactions. Audit trails must show:

- Who interacted

- What verification steps occurred

- How identity was established

- What disclosures were made

- How the officer reached a decision

MiFID II, RBI’s V-CIP rules and FFIEC guidelines all emphasise the need for retained, reviewable, tamper-proof evidence.

Generic tool limitations

Generic platforms only provide:

- Basic meeting metadata (join/leave times)

- Raw recordings lacking structured context

- No tagging of verification steps

- No officer actions logs

- No binding of video evidence to customer records

Risk to the institution

During audits or disputes, institutions may not be able to demonstrate how identity was verified or how decisions were made. Lack of defensible evidence is one of the most common findings in regulatory examinations.

3.3 Data Protection, Encryption and Data Residency

Regulator expectations

Data must be:

- Encrypted end-to-end

- Stored in permitted jurisdictions

- Retained according to product-specific policies

- Accessible only to authorised personnel

- Deleted according to regulatory timelines

GDPR, FFIEC and RBI all impose strict data governance obligations.

Generic tool limitations

Generic tools usually:

- Store video data in vendor-controlled clouds that may cross jurisdictions

- Do not provide configurable, journey-based retention policies

- Cannot ensure evidence remains in country-specific data centers

- Offer limited administrator visibility into where video files reside

Risk

An institution could violate data protection or residency rules, triggering fines or forced remediation programs.

3.4 Access Control, Officer Authentication and Insider Risk

Regulator expectations

Only authorised personnel should handle regulated customer interactions. Access must be:

- Role-based

- Logged

- Monitored

- Segregated by product and risk type

Generic tool limitations

- Meeting links can be forwarded

- No mapping of officer roles to allowed journey types

- No maker-checker controls

- Admin privileges are overly broad

Risk

Unauthorised personnel can engage with customers in regulated processes, exposing the institution to mis-selling, misconduct and operational risk.

3.5 Conduct Risk, Advisory Surveillance and Disclosures

Regulator expectations

In many jurisdictions, investment and lending interactions must include:

- Mandatory disclosures

- Agent supervision

- Conduct monitoring

- Conversation recording and retention

MiFID II specifically requires investment conversations to be recorded and reviewable.

Generic tool limitations

- No tagging of advisor interactions

- No product-level templates or scripts

- No compliance checkpoints

- No structured storage for disclosure evidence

- No supervision workflows

Risk

Institutions are exposed to mis-selling allegations, unsuitable advice claims and conduct-related regulatory penalties.

3.6 AML and Fraud Controls Integration

Regulator expectations

Remote interactions should feed into AML systems to provide:

- Risk scoring

- Red flag detection

- Suspicious activity escalation

- Fraud analytics

Generic tool limitations

- No structured events or signals flow into AML systems

- No indicators for high-risk behavior

- No integration pathways into case management

Risk

AML monitoring becomes fragmented and incomplete, a key driver of global enforcement actions.

4. Comparison: Generic Video Tools vs Purpose-Built Video Banking Platforms

Control Area | Regulator Expectation | Generic Tools | Purpose-Built Solutions |

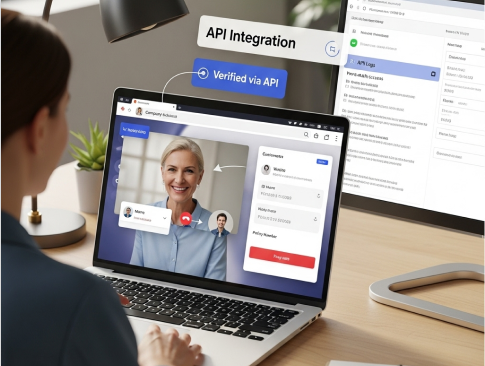

Identity Verification | Liveness, document capture, officer supervision | Not supported | Built-in V-CIP workflows |

Audit Trails | Structured evidence | Raw recordings | Event-level logs |

Data Protection | Encryption, residency | Vendor-controlled | Bank-controlled region-specific storage |

Access Control | RBAC, officer authentication | Weak | Journey-level permissions |

Conduct & Surveillance | Disclosures, recording | No enforcement | Scripts, supervision dashboards |

AML Integration | Data feeds, risk triggers | None | Structured journey data |

5. Practical Consequences for Financial Institutions

Using generic video tools for regulated interactions can lead to:

- Regulatory findings for KYC/V-CIP deficiencies

- Weak AML programs due to poor identity assurance

- Customer disputes with insufficient evidence to defend decisions

- Higher fraud exposure due to lack of liveness and deepfake controls

- Data leakage or non-compliant storage

- Inconsistent customer experience across officers

6. What Banks Should Demand from a Compliant Video Platform

A defensible video infrastructure should include:

6.1 Regulation-Mapped Workflows

Aligned with RBI V-CIP, FFIEC guidelines, GDPR and internal credit policies.

6.2 Evidence by Design

Structured logs, liveness proof, document capture, officer actions, timestamps.

6.3 Enterprise-Grade Security

End-to-end encrypted communication, region-specific data storage and granular retention.

6.4 Supervision and Conduct Monitoring

Review dashboards, risk flags and disclosure enforcement.

6.5 AML and Fraud Integration

Journey-level signals that feed straight into AML systems.

These principles underpin platforms in the secure video banking category, designed specifically for BFSI.

7. Transitioning Away from Generic Tools

A phased transition is ideal:

- Identify all customer journeys involving video.

- Prioritise onboarding, lending PDs, wealth advisory and collections.

- Deploy a compliant video layer in parallel.

- Migrate high-risk journeys first.

- Integrate evidence storage and supervision dashboards.

Institutions that complete this transition reduce audit friction, enhance fraud resilience and strengthen digital transformation outcomes.

Generic video tools are excellent for collaboration but fundamentally misaligned with BFSI compliance requirements. Regulations around identity verification, audit trails, data protection, AML and conduct oversight now demand structured, secure and fully traceable video journeys. With AML and KYC penalties climbing dramatically and regulators sharpening expectations, relying on generic tools introduces systemic risk.

Purpose-built video banking platforms, designed with compliance at the core, provide the defensible infrastructure institutions need. They embed verification, evidence capture, officer governance and AML signals directly into the video workflow.

Financial institutions seeking to future-proof their remote customer journeys should explore compliant video layers aligned with regulatory expectations.