V-CIP Explained: A Complete Guide for Banks and NBFCs

Introduction

Customer onboarding in India has evolved rapidly over the past decade. Traditional KYC processes were slow, heavily paper-driven and dependent on physical interactions, which created friction for customers and operational burdens for financial institutions. As digital banking accelerated and remote engagement became the norm, the Reserve Bank of India (RBI) introduced a transformative framework known as V-CIP, or Video-based Customer Identification Process.

V-CIP allows banks and NBFCs to complete customer identification through a secure, supervised video interaction. RBI considers this process equivalent to in-person verification when performed under the prescribed controls (RBI, 2020). This shift has reduced onboarding barriers, improved customer convenience and aligned India with global trends in remote identity verification.

This guide covers how V-CIP works, why RBI introduced it, what the mandatory requirements are, common mistakes to avoid and how technology platforms such as VideoCX.io support compliant implementations.

1. What Is V-CIP

V-CIP, or Video-based Customer Identification Process, is an RBI-approved method that enables banks and NBFCs to verify a customer’s identity through a real-time audio and video interaction. A trained officer supervises the session, verifies the customer’s documents, performs liveness checks and captures evidence required for regulatory approval.

RBI defines V-CIP as an “alternate method of customer identification with facial recognition and customer due diligence”, and explicitly treats it as comparable to face-to-face verification when all controls are followed. This places V-CIP in the category of full KYC, not limited or partial KYC.

V-CIP allows institutions to onboard customers entirely remotely while maintaining the integrity of identity verification and compliance standards.

2. Why RBI Introduced V-CIP

RBI introduced V-CIP to achieve a balance between digital convenience and regulatory security. Several factors contributed to its introduction.

2.1 Rising need for digital-first onboarding

India has witnessed tremendous growth in digital payments, digital lending, mobile banking and fintech adoption. Customers increasingly expect remote onboarding without branch visits. A secure digital alternative to physical KYC became essential.

2.2 Addressing operational inefficiencies

Physical KYC involved paperwork, field visits, branch queues and manual verification. These steps created delays, increased costs and introduced operational risk. A video-based approach reduces friction and accelerates activation.

2.3 Strengthening fraud prevention

Digital onboarding can attract identity fraud attempts, especially with manipulated images or videos. V-CIP incorporates safeguards such as liveness checks, facial matching and geo-location verification to reduce fraud risk.

2.4 Pandemic and public-health considerations

The COVID-19 pandemic made physical verification unviable across many locations. V-CIP ensured business continuity while maintaining regulatory compliance.

2.5 Alignment with global regulatory evolution

Regulators in Singapore, the European Union and the United States also recognise supervised remote identity verification as a legitimate alternative to physical checks. RBI’s V-CIP framework reflects similar global principles while remaining tailored to India’s risk environment.

3. How V-CIP Works

Although V-CIP involves multiple checks and safeguards, the overall process is straightforward when broken into structured steps.

Step 1: Customer initiates the V-CIP journey

The customer requests V-CIP through a mobile app, website or support channel. Basic details such as name, PAN and contact information are collected.

Step 2: Preliminary digital checks

Before the live interaction, systems usually perform document extraction, basic screening, sanctions list checks and validation of the customer’s device and camera capabilities.

Step 3: Live supervised video interaction

A trained officer conducts the real-time video interaction. During this session, the officer verifies the customer’s appearance, matches the face with the documents, checks liveness, examines the ID for authenticity and confirms that the customer understands and consents to the process.

Step 4: Geo-location capture

V-CIP requires geo-tagging to verify that the customer is physically present in India during the interaction. This requirement is a core control within RBI’s framework.

Step 5: Evidence capture and encrypted storage

The officer captures photographs of the customer and identity documents, along with a time-stamped recording. The entire session must be stored in encrypted, tamper-proof systems that meet RBI’s expectations on data security.

Step 6: Maker-checker approval

A second officer or compliance reviewer examines the evidence and approves or rejects the V-CIP session. This step ensures quality control and reduces the likelihood of human error.

Once approved, the customer’s account is activated with full KYC status.

4. RBI’s Key Requirements for V-CIP

The RBI framework defines clear expectations for banks and NBFCs. The following is a beginner-friendly summary of the critical requirements that must be followed.

Live interaction

The session must be real-time and synchronous. Pre-recorded videos or manipulated submissions are not allowed.

Officer training

Only designated, trained officers can conduct V-CIP. They must follow institution-approved scripts, document-handling protocols and fraud detection procedures.

High quality of video and audio

The resolution must be adequate to verify faces, signatures, holograms and other security elements on identity documents.

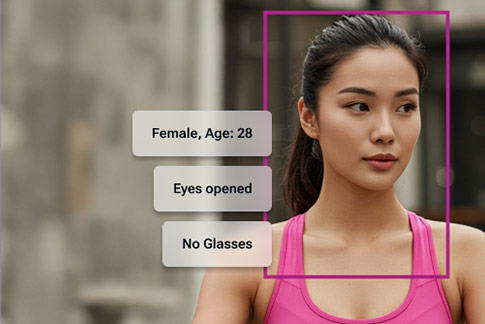

Liveness and facial matching

The officer must confirm that the customer is physically present and matches the ID provided. Liveness checks help prevent spoofing attempts and deepfake-driven fraud, which have become more common across digital KYC channels.

Geo-tagging and time-stamping

The system must capture the customer’s location during the interaction and confirm it is within India, as mandated by the RBI.

Encrypted communication and storage

The video stream and captured evidence must be transmitted and stored securely. Industry standards such as AES-256 encryption, ISO 27001 certification or private cloud deployments are typically used.

Audit trail maintenance

Institutions must record officer details, customer details, documents reviewed, timestamps, annotations and system actions. This ensures transparency during regulatory audits.

Maker-checker mechanism

A secondary verification step is compulsory to ensure unbiased approval and reduce fraud risk.

Document integrity checks

Officers must inspect edges, glare, holograms and fonts and must examine the PAN or other documents clearly through zoom or frame-freeze tools.

Limited retries

Banks must track failed V-CIP attempts and treat repeated failures as potential red flags in AML processes.

5. Benefits of V-CIP for Banks and NBFCs

V-CIP provides benefits that extend across operations, compliance and customer experience.

Faster onboarding

Traditional KYC can take several days, especially when physical verification is required. V-CIP reduces the onboarding time to minutes, increasing conversion rates.

Lower operational costs

By replacing in-person verification, institutions save on logistics, agent visits, manual paperwork and branch workloads. Industry analyses show that digital KYC can reduce onboarding costs by as much as 90 percent compared with traditional methods

Enhanced fraud prevention

Liveness detection, geo-tagging, supervised verification and AI-driven document checks significantly lower identity fraud risk.

Regulatory legitimacy

RBI acknowledges V-CIP as a full KYC method, allowing institutions to onboard customers remotely while maintaining compliance confidence.

Improved customer experience

Customers can complete KYC from their homes without scheduling branch visits or waiting for field agents.

6. Common Mistakes Institutions Make During V-CIP

Even though V-CIP is conceptually simple, implementation errors can create compliance gaps. The following mistakes are frequently observed.

Using generic video platforms

Platforms such as Zoom or Teams do not provide the required controls for liveness, geo-tagging, encrypted storage or structured audit trails. They are not designed for regulated identity verification.

Inadequate officer training

A successful V-CIP session depends heavily on the officer’s skill in verifying documents, identifying anomalies and following mandated procedures. Insufficient training increases the risk of errors.

Poor technical quality

Blurry images, unstable internet and weak lighting can lead to incomplete or inaccurate verification.

Weak backend integration

If V-CIP data is not integrated with the institution’s core banking, CRM or AML systems, onboarding cannot be completed efficiently.

Ignoring retention and access policies

RBI expects institutions to maintain strict control over stored V-CIP evidence. Mismanagement can create serious audit challenges.

7. How Technology Platforms Support Compliant V-CIP

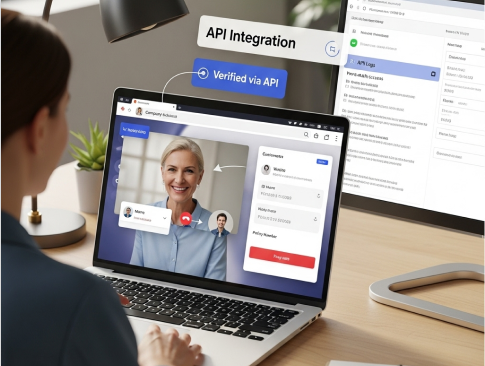

The success of V-CIP depends largely on the capabilities of the technology platform used to deliver and manage the verification process. Modern secure video banking solutions, such as VideoCX.io, provide a compliance-ready foundation while supporting high-quality customer experiences.

End-to-end V-CIP workflows

Purpose-built systems offer automated liveness detection, facial matching, geo-tagging, document capture and officer scripts that ensure consistent verification.

Encrypted and region-specific data storage

Institutions can store V-CIP recordings and evidence in secure, India-based environments that comply with RBI expectations and privacy regulations.

Tools for officers

Features such as zooming, frame freezing, side-by-side document comparisons and scripted guidance improve verification accuracy.

Built-in maker-checker dashboards

Compliance reviewers can access structured evidence, annotations, recordings and system logs in a single place.

Integration with core systems

APIs enable smooth transfer of verified data into core banking, lending or AML platforms to complete onboarding without operational gaps.

These capabilities reduce human error, strengthen compliance and speed up onboarding delivery at scale.

8. V-CIP Compared with Other KYC Methods

The following comparison helps beginners understand how V-CIP fits into the broader KYC landscape.

Feature | V-CIP | Aadhaar eKYC | Offline KYC |

Customer Interaction | Live video with bank official | OTP or biometric | Physical submission |

Fraud Prevention | High (liveness, face match, supervised) | Medium | Medium |

Regulatory Acceptance | Full KYC | Accepted but limited in some cases | Full KYC |

Convenience | Very high | High | Low |

Required Infrastructure | Video KYC platform | Aadhaar API | Branch or agent |

V-CIP sits between high compliance rigor and high digital convenience, making it an ideal method for remote, secure onboarding.

9. Implementation Roadmap for Banks and NBFCs

Institutions can introduce V-CIP smoothly by following a structured roadmap.

Define SOPs aligned to RBI guidelines

This includes officer scripts, document handling rules, retry policies and fraud escalation guidelines.

Select a compliant technology provider

Look for features such as encrypted communication, AI-based checks, geo-tagging, audit trails and scalable infrastructure.

Train V-CIP officers

Training should cover document reading, fraud red flags, communication skills and system usage.

Integrate backend systems

Ensure that identity data and verification results pass directly into onboarding and compliance systems.

Run controlled pilots

Begin with specific product lines or customer segments to test workflows.

Monitor continuously

Regular audits and feedback loops help maintain quality and compliance maturity.

V-CIP has rapidly become a foundational element of digital customer onboarding for banks and NBFCs in India. It combines the regulatory strength of face-to-face verification with the convenience and efficiency of digital workflows. When implemented correctly, V-CIP reduces onboarding time, controls fraud risk, lowers operational costs and creates a seamless experience for customers.

The effectiveness of V-CIP depends heavily on the underlying technology, officer training and adherence to RBI’s guidelines. Platforms such as VideoCX.io enable institutions to meet these expectations by offering secure, compliant and reliable video verification journeys.