Credit Saison digitizes Personal Discussions with VideoCX.io

Credit Saison adopted VideoCX.ios Video PD platform

to reduce costs, improve efficiency, and expand business reach across India.

At a glance

- Industry: NBFC (Business & Retail Lending)

- Location: India

- Use Case: Video Personal Discussion (Video PD) – SaaS

- Departments Covered: Business Loans, Small Business Loans, Loan Against Property

- Go-Live Date: 1st Dec 2022

Credit Saison

Credit Saison is a leading financial services company providing business and retail loans across India. The company faced challenges with traditional physical personal discussions (PDs), which were time-consuming, costly, and difficult to scale. To enhance efficiency, reduce fraud risk, and improve oversight, Credit Saison partnered with VideoCX to digitize PDs on a secure, browser-based platform.Challenges

- Time-consuming PDs: Physical discussions led to longer turnaround times and limited scalability.

- Lack of visibility: Senior management had no oversight of commitments made by credit officers during onsite visits.

- No digital audit trail: Increased fraud risk and reduced accountability.

- High operational costs: Travel and manual coordination drove up expenses.

Solution by VideoCX.io

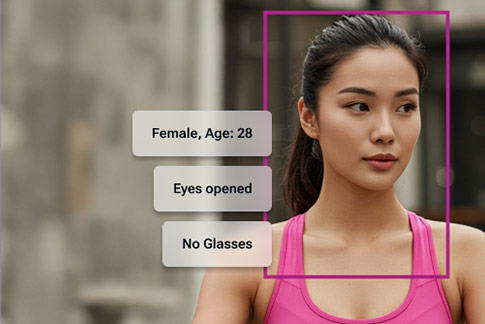

- Secure Video PD platform: Conducted PDs digitally via a browser-based solution.

- Permanent digital records: Every PD recorded for fraud prevention and audit-readiness.

- Managerial support: National Credit Managers reviewed calls and supported credit officers in decision-making.

- Efficiency gains: Replaced physical PDs with digital sessions, reducing costs and improving productivity.

Implementation

- Credit Officers sent customers a VideoCX link via SMS.

- Customers initiated sessions by clicking “Start Chat.”

- Customers shared documents for verification, including:

- PAN card for ID proof

- Voter ID / Driving License / Passport / Electricity Bill for address proof

- Property inspection over video for LAP loans

- Stock/inventory checks, business surroundings, office number, GST number for SME loans

- Live location sharing enabled real-time verification.

- Calls concluded with outcomes marked as Success / Reject / Pending with comments.

- Recordings were stored permanently, and supervisors reviewed them via Chat link with Video Recording before final loan approval/disbursement.

Results & Impact

- Lower costs per PD : Reduced travel and manual overhead.

- Faster loan approvals : National Credit Managers supported decision-making in real time.

- Fraud risk reduction : Digital audit trails ensured accountability and compliance.

- Expanded reach : Business scaled across India, beyond branch limitations.

Ready to digitize Personal Discussions at scale?

See how VideoCX.io’s Video Personal Discussion (Video PD) platform helps banks and NBFCs reduce fraud risk, improve oversight, and scale loan operations without physical visits.

Explore more VideoCX case studies:

Read how leading banks have used VideoCX.io’s video banking platform to digitize customer onboarding and personal discussions, and customer servicing.

Life Insurance: Godrej Capital | Protium Finance | Aditya Birla Housing Finance | L&T Financial Services | IIFL Finance| SMFG India Credit | Poonawalla Fincorp | Tata Capital

You can also explore case studies across Banking, Lending, and General Insurance.