Video KYC: Redefining Digital Onboarding for India’s Financial Institutions

The financial sector in India is rapidly transitioning to a digital-first future. This change is defined by two forces: speed and trust. Consumers now demand immediate onboarding, digital verification, and visible security, particularly in the premium and institutional segments.

This expectation can no longer be met by traditional Know Your Customer (KYC) procedures that depend on in-branch verification and physical documentation.

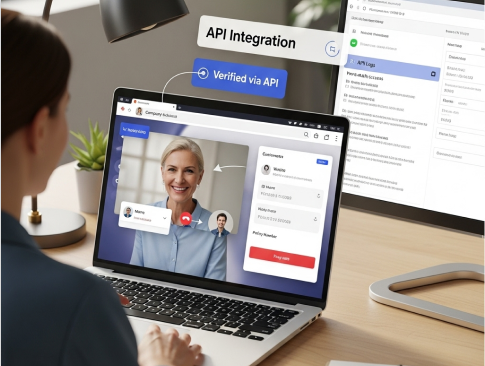

Video KYC has emerged as a crucial tool for striking a balance between convenience and compliance. It gives financial institutions the human assurance of face-to-face interactions while enabling them to securely and effectively complete regulatory verification.

What Is Video KYC?

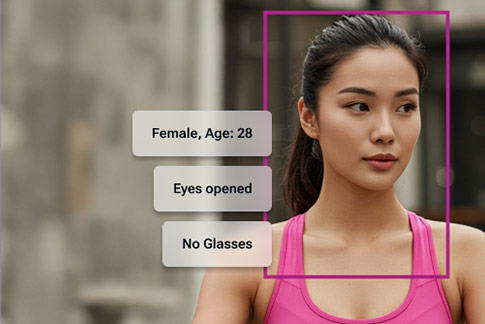

Video KYC, or Video-based Customer Identification Process (V-CIP), is a secure, real-time method that enables customer verification through live video interaction. A trained verifier confirms the customer’s identity using government-issued documents, facial matching, and liveness detection

The foundation for KYC compliance in India was laid by the RBI Master KYC Direction (2016). Subsequent circulars and updates broadened its scope to permit video KYC under controlled conditions, guaranteeing secure audit trails, data protection, and geotagging.

Video KYC strengthens security and customer confidence by reintroducing personal interaction into digital banking, in contrast to eKYC or document upload workflows.

Why Video KYC Matters Now

1. A Digital-First Population

India has over 1.4 billion Aadhaar-linked accounts, and smartphone penetration exceeds 75 percent in urban areas.

(Source: UIDAI Statistics, 2024; Comprehensive Modular Survey: Telecom, 2025)

This digital infrastructure supports scalable, compliant identity verification across banking, insurance, and lending sectors.

2. Regulatory Support

The RBI’s 2023 update to the KYC Master Direction permitted re-KYC through digital video verification for existing customers and extended eligibility to proprietorships and signatories.

(Source: KPMG summary of RBI KYC amendments, 2023)

This regulatory clarity has accelerated the adoption of video-based identity verification in the BFSI sector.

3. Strengthening Fraud Prevention

According to the PwC India Global Economic Crime Survey 2024, 59 percent of Indian organizations experienced economic or financial crime in the past two years. Identity theft and cyber fraud were among the top risks.

Video KYC systems help counter these risks through AI-driven liveness detection, face matching, and secure human supervision.

4. Improving Customer Experience

Lengthy onboarding remains a major cause of customer drop-offs in banking and insurance. Video KYC eliminates paperwork and branch visits, creating a faster, smoother first impression that aligns with customer expectations for digital convenience and professionalism.

How Video KYC Works

A compliant Video KYC workflow typically includes the following steps:

- Session initiation: The customer launches a secure session via the bank’s portal or app.

- Document verification: The verifier checks Aadhaar, PAN, or passport details using OCR and document authenticity tools.

- Liveness and facial match: AI confirms the customer’s live presence and identity match.

- Geo-location validation: The system confirms that the session originates within India.

- Live verification: A human officer interacts with the customer, clarifies queries, and approves verification.

- Audit and storage: The session is encrypted, time-stamped, and archived for audit purposes.

A hybrid of automation and human oversight enables onboarding to be completed in under five minutes in most cases.

Regulatory and Security Framework

Video KYC operates under strict RBI-defined conditions, including:

- Encrypted video streams

- Verified and trained bank officials conducting sessions

- Clear audio-visual capture and storage

- Automated timestamp and geotagging

- Data localization within India

- Immutable audit logs

Solutions like VideoCX.io ensure compliance through modules such as On-Premise Data Viewer and Dashboards & Reporting, giving compliance teams real-time oversight.

Industry Impact and Market Outlook

In India, analysts expect the market to cross USD 3.7 billion by 2028, driven by fintech and digital banking expansion.

(Source: Entrepreneur India, 2024)

Research from McKinsey & Company shows that institutions implementing digital onboarding frameworks achieve over 30 percent faster applicant onboarding and a reduction in cost per customer of up to 28 percent compared to those using manual processes.

These statistics demonstrate that video KYC is now a structural requirement in regulated financial services rather than an emerging experiment.

Advantages of Video KYC

- Frictionless onboarding: Instant verification without physical visits.

- Enhanced security: AI-powered liveness and facial recognition combined with trained human supervision.

- Regulatory compliance: Fully aligned with RBI’s KYC Master Direction and data-protection mandates.

- Operational efficiency: Reduced turnaround times and costs.

- Improved brand perception: Projects innovation and reliability for digitally mature clients.

Why Financial Institutions Choose VideoCX.io

VideoCX.io, one of India’s leading verification platforms, provides modular integration and enterprise-grade scalability:

- AI-based Verification: Adaptive face matching and OCR (see AI-Based Video Analysis).

- Custom Integrations: Easy embedding through the WebView SDK for Customer App and APIs.

- Regulatory Alignment: Native support for RBI audit standards and Indian data-residency norms.

- Scalability: Supports Credit Verification (Video PD) and Insurance Policy Servicing).

- Quality Control: Real-time monitoring through the Checker Module).

- Secure Infrastructure: Hosted on encrypted, high-availability AWS systems (Powered by AWS).

Measurable Business Outcomes

Adopting Video KYC has delivered significant benefits for Indian banks and NBFCs:

- Onboarding time reduced by up to 85 percent

- Verification costs reduced by around 50 percent

- Fraudulent applications lowered by 35 to 40 percent

- Higher satisfaction and retention among digital customers

The Future of Video KYC

Emerging innovations are enhancing security and usability further:

- Deepfake detection and 3D liveness analysis for authenticity assurance

- Continuous or periodic video re-KYC models through secure APIs

- Blockchain-based KYC data sharing for interoperability and transparency

- Multi-modal biometrics combining voice, face, and gesture inputs

- Explainable AI systems that make automated verification auditable for regulators

The Bank for International Settlements (BIS) Working Paper, 2024, predicts that AI-enabled KYC automation could save global banks more than USD 10 billion annually by 2030 through improved fraud prevention and compliance efficiency.

Conclusion

Video KYC evolved from a compliance tool to a strategic driver of customer trust in India’s regulated financial environment. It offers personalization, speed, and security without sacrificing compliance.

The technology, scalability, and control required for a smooth and reliable digital onboarding process are offered by platforms such as VideoCX.io.

Explore Video KYC Features to see how India’s top financial institutions are building secure, customer-centric onboarding experiences with VideoCX.io.