Axis Bank drives mass adoption of

Video KYC with VideoCX

Axis Bank leveraged VideoCX’s scalable cloud and AI-powered support to complete millions of Video KYCs, reduce onboarding costs, and enhance customer experiences.

At a glance

- Industry: Banking

- Location: India

- Journeys live: Video KYC, Video Banking, Digital Onboarding

- Spokesperson: Sameer Shetty, President & Head – Digital Business & Transformation

At a glance

- Industry: Banking

- Location: India

- Journeys live: Video KYC, Video Banking, Digital Onboarding

- Spokesperson: Sameer Shetty, President & Head – Digital Business & Transformation

Axis Bank

Axis Bank, established in 1993, is one of India’s leading private sector banks. It offers a wide portfolio of retail, corporate, and wealth management services through branches, ATMs, and digital channels. Known for its innovative approach, Axis Bank has been a pioneer in adopting digital-first solutions to serve both urban and rural customers.

Challenges

- Digital onboarding complexity – Customers faced issues with video KYC due to poor networks, incompatible browsers, or outdated devices.

- Customer experience optimisation – Needed a seamless, end-to-end digital journey to reduce branch reliance.

- Building for scale – Manual processes led to high onboarding costs and longer account opening times.

Solution by VideoCX

- Cloud-based scalability – VideoCX enabled Axis Bank to manage high volumes of video KYC calls, even during peak periods.

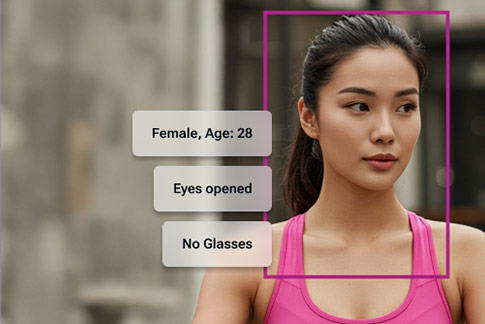

- AI-powered support – Tools proactively detected network and device issues, optimising the environment before calls began.

- Cost efficiency – Video KYC and video banking reduced onboarding costs by 40–60%, speeding up account creation.

Implementation

- Adopted VideoCX’s secure, cloud-based platform for digital onboarding.

- Integrated AI tools to support both customers and staff during KYC sessions.

- Rolled out video banking to enable real-time interactions with relationship managers for servicing and transactions.

Results & Impact

- Mass adoption of Video KYC – Since 2020, Axis Bank has processed 5 lakh+ video KYCs monthly, becoming one of India’s largest users.

- Customer-centric video banking – Customers could interact directly with relationship managers via video, completing transactions instantly.

- Improved operational efficiency – Boosted frontline staff productivity and enabled a fully digital, cost-effective onboarding journey.

Testimonial

“VideoCX has truly transformed how we connect with customers, delivering personalized, face-to-face experiences at scale.”— Sameer Shetty, President & Head – Digital Business & Transformation