Bajaj Allianz Life Insurance streamlines customer service with VideoCX.io

Bajaj Allianz Life Insurance launched a unified video policy servicing platform with VideoCX.io to deliver faster, personalized, and convenient policyholder support across channels.

At a glance

- Industry: Life Insurance

- Location: India

- Use Case: Real-time Video Servicing and Query Resolution

- Channels Covered: Mobile App, Website, WhatsApp Bot

- Go-Live Date:Not specified in source

At a glance

- Industry: Life Insurance

- Location: India

- Use Case: Real-time Video Servicing and Query Resolution

- Channels Covered: Mobile App, Website, WhatsApp Bot

Bajaj Allianz Life Insurance

Bajaj Allianz Life Insurance is one of India’s leading life insurers offering protection and savings solutions to millions of customers. Policyholders with multiple policies often faced friction when selecting the right one for servicing, and traditional support channels added complexity. To improve efficiency and deliver a uniform customer experience, Bajaj Allianz partnered with VideoCX to launch a centrally hosted video servicing platform.

Challenges

- Policyholder friction → Customers with multiple policies struggled to find the right policy for servicing.

- Traditional support limitations → Existing channels made it difficult to match customer needs with the right language and service flow.

- Slow resolution → Multiple verification and servicing steps led to longer turnaround times.

Solution by VideoCX.io

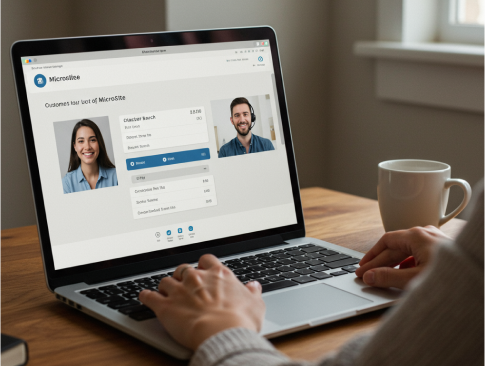

- Unified video servicing platform → Accessible via mobile app, website, and WhatsApp bot.

- Automatic policy fetch → Allowed quick selection for customers with multiple policies.

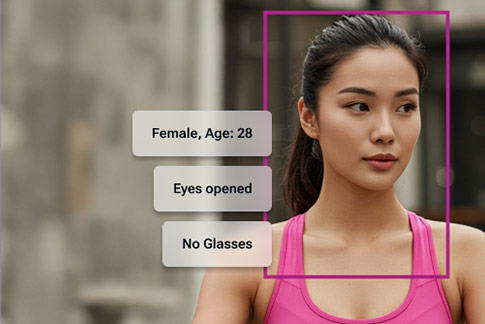

- Secure identity validation → Ensured safe and compliant interactions.

- Language preference → Delivered personalized support in the customer’s preferred language.

- End-to-end servicing → Enabled customers to complete service requests entirely on video.

Implementation

- Deployed a centrally managed platform to ensure consistent servicing across all channels.

- Integrated automatic policy fetching and secure customer identity verification.

- Allowed customers to choose language preferences for a more personalized experience.

- Offered servicing journeys and query resolution through app, web, and WhatsApp bot.

Results & Impact

- Faster resolutions → Reduced turnaround times for policyholder servicing.

- Personalized experience → Language choice and automatic policy fetch simplified interactions.

- Reduced drop-offs → Seamless video journeys minimized customer effort.

- Consistent service → Centrally hosted system ensured uniform support across all channels.

Ready to unify policy servicing across channels at scale?

See how VideoCX.io’s centrally hosted video servicing platform helps life insurers deliver faster, personalized policyholder support across app, web, and WhatsApp while ensuring secure, compliant interactions.

Explore more VideoCX.io case studies

Discover how leading banks and insurers use VideoCX.io’s video banking platform to unify customer servicing, onboarding, lending, and personal discussions across digital channels and regulated journeys.

Life Insurance: Aditya Birla Sun Life Insurance| HDFC Life | Max Life Insurance | PnB Metlife

You can also explore case studies across Banking, Lending, and General Insurance.