PnB MetLife builds a hybrid virtual branch model with VideoCX.io

PnB MetLife adopted VideoCX.io’s video kiosk solution to deliver branch-like

experiences for sales, servicing, and claims without expanding physical locations.

At a glance

- Industry: Life Insurance

- Location: India

- Use Case: Virtual Branch – Video Kiosk for Sales, Servicing & Claims

- Departments Covered: Sales, Customer Service, Claims

At a glance

- Industry: Life Insurance

- Location: India

- Use Case: Virtual Branch – Video Kiosk for Sales, Servicing & Claims

- Departments Covered: Sales, Customer Service, Claims

PnB MetLife Insurance

PnB MetLife Insurance, a leading life insurer in India, faced challenges in providing specialized product knowledge and resolving claims efficiently due to limited staff at branch locations. Expanding physical branches was costly and resource-heavy. To overcome these hurdles, the company partnered with VideoCX to deploy video kiosks, enabling virtual access to experts across sales, servicing, and claims.

Challenges

- Limited staff expertise → Branch staff shortages reduced the ability to provide in-depth product knowledge.

- Claim delays → Lack of direct access to subject matter experts slowed claim settlements.

- High expansion costs → Setting up new physical branches required significant investment.

Solution by VideoCX

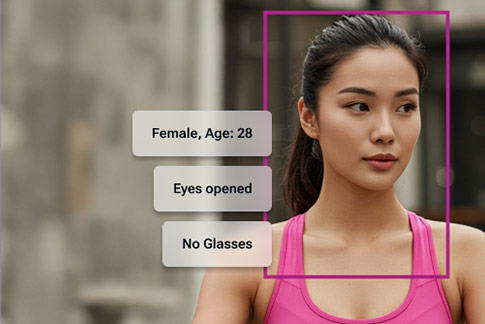

- Dedicated video kiosks → Installed across PnB MetLife branches for customer access.

- Instant expert connection → Customers connected via one-click video call with subject matter experts.

- Comprehensive support → Product explanations, policy updates, and claim guidance delivered via secure video sessions.

- Backend integration → Representatives accessed policy history and customer details instantly.

- Audit readiness → All sessions securely recorded and compliant for regulatory standards.

Implementation

- Video kiosks were deployed across key city branches.

- Customers used kiosks to connect directly with subject matter experts.

- Experts handled:

- Policy purchase assistance and illustrations

- Policy changes and premium updates

- Claim documentation and settlement support

-

Integrated backend systems provided real-time policy and customer information.

Results & Impact

- Branch-like service, virtually → Customers experienced in-depth service even in locations with limited staff.

- Improved satisfaction → Faster claims and personalized guidance boosted customer confidence.

- Virtual branch expansion → Reach extended without high costs of opening new locations.

- Reduced TAT → Faster turnaround for claims and service requests.

- Future-ready model → Combined physical presence with digital expertise.

Ready to build virtual branches without expanding physical locations?

See how VideoCX.io’s video kiosk and virtual branch platform helps life insurers extend expert-led sales, servicing, and claims support across branches while controlling costs and maintaining regulatory compliance.

Explore Virtual Branch & Video Kiosks

Explore more VideoCX.io case studies

Learn how banks and insurers use VideoCX.io’s video banking platform to deliver branch-like experiences through virtual branches, video kiosks, remote onboarding, lending, and policy servicing across regulated customer journeys.

Life Insurance: Aditya Birla Sun Life Insurance| HDFC Life | Max Life Insurance | Bajaj Allianz Life Insurance

You can also explore case studies across Banking, Lending, and General Insurance.