HDFC Life Insurance enhances

policy servicing with VideoCX.io

HDFC Life Insurance integrated VideoCX.io’s video policy servicing into its website to reduce branch dependency, improve customer experience, and increase operational efficiency.

At a glance

- Industry: Life Insurance

- Location: India

- Use Case: Policy Servicing over Video

- Departments Covered: Customer Service, Policy Servicing, Operations

HDFC Life Insurance

HDFC Life Insurance is one of India’s leading life insurers, providing a wide range of protection and savings products. Customers often faced delays and friction when resolving service requests through branches or call centers. To modernize operations, reduce dependency on physical visits, and deliver faster servicing, HDFC Life adopted VideoCX.io’s secure video servicing solution.

Challenges

- Long waiting times: Customers had to make multiple branch visits for simple service requests.

- Limited personalization: Call center interactions lacked integrated customer data.

- Drop-offs: Service requests often couldn’t be resolved in one go, increasing abandonment.

- High operational costs: Branch dependency drove up servicing expenses.

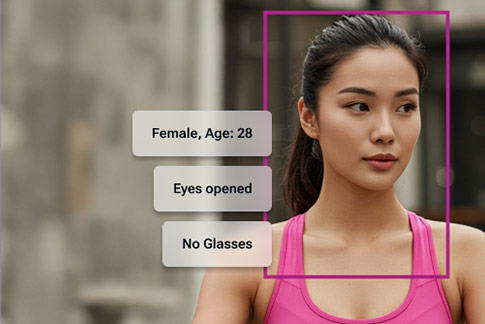

Solution by VideoCX.io

- Integrated video servicing: Directly embedded into HDFC Life’s website.

- Instant customer connection: Customers logged in with policy details and connected securely with service executives.

- API integration: Real-time access to customer history enabled personalized support.

- End-to-end service resolution: Requests were handled completely over video without branch visits or paperwork.

Implementation

- Customers accessed the “Video Servicing” option on the HDFC Life website.

- By entering policy credentials, a secure video session was initiated.

- Executives greeted customers with pre-fetched details and history.

- Customers completed service requests such as:

- Address change

- Nominee update

- Document submission & verification

- All interactions were securely recorded and stored for compliance and audit readiness.

Results & Impact

- Improved customer experience: Faster, personalized, and convenient servicing.

- Reduced branch dependency: Saved customer time and reduced company resource costs.

- Higher operational efficiency: More requests resolved in a single video session.

- Stronger trust: Secure, transparent, and recorded interactions increased customer confidence.

Ready to digitize policy servicing at scale?

See how VideoCX.io’s secure video servicing platform helps life insurers reduce branch dependency, resolve service requests faster, and deliver compliant, end-to-end customer support without physical visits.

Explore more VideoCX case studies

Discover how leading banks and insurers use VideoCX.io’s video banking platform to digitize customer onboarding, policy servicing, lending, and personal discussions across regulated journeys.

Life Insurance: Aditya Birla Sun Life Insurance| Bajaj Allianz Life Insurance | Max Life Insurance | PnB Metlife

You can also explore case studies across Banking, Lending, and General Insurance.